Commentary

A paradigm shift in gold

August 27, 2024

Gold prices reached record highs in early 2024 on the back of increasing central bank demand for the precious metal. As questions about de-dollarization and government debt potentially threaten the U.S. dollar, Hoa Hong, Portfolio Manager, Resources with BMO GAM’s Global Equity Team and manager of the BMO Precious Metals Fund and BMO Resource Fund (the latter co-managed with Phil Harrington) traces the evolution of gold as an asset class, evaluating key risks and examining its strategic role in institutional portfolios.

A golden year so far

The first half of 2024 has seen spot gold prices reach record highs, with the precious metal topping US$2,400 per ounce on May 17 and again on July 11 driven largely by central bank purchases and retail buying, especially in China. Historically, gold prices have tended to have a fairly close inverse correlation with real interest rates, often rising when real interest rates are low or negative. Within the past two years, however, gold has broken away from that trend—an indication that central bankers are not as deterred by high prices as compared to other consumers of gold.1

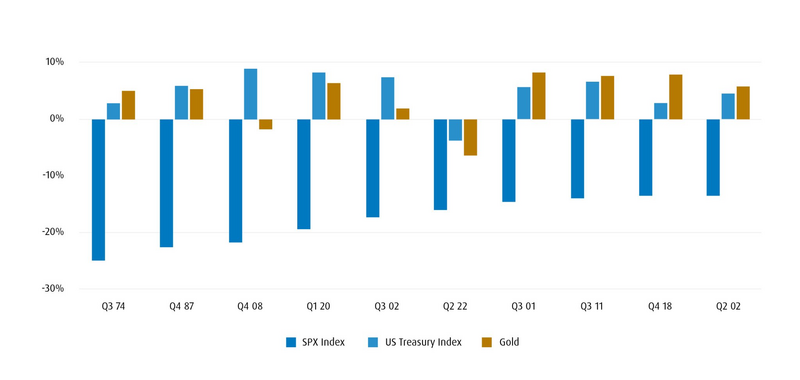

The benefits of an allocation to gold are well-understood. Its relatively low correlation with other asset classes makes it an attractive diversifier; in fact, as Chart 1 below demonstrates, gold has generated a positive return in eight of the 10 worst historical quarters for U.S. equities. It also has a long history as a store of value—a ‘safe haven’ hedge against inflation and economic downturns.2 Since the end of the gold standard, one of the greatest tail risks has been the potential for currency devaluation due to the rapid increase in money supply as a result of fiscal and central bank policies. Gold’s demonstrated ability to keep up with real purchasing power has been especially useful as a means of mitigating that risk. Despite gold’s benefits, however, only approximately 7% of institutions in North America have a specific allocation to it in their portfolios, according to a 2022 study by the World Gold Council (WGC).3 Global positions in gold ETFs have also declined over the past two years as the price of gold has risen4—another sign that investors’ allocation to the precious metal remains relatively light.

Chart 1. Gold provides downside protection

Gold returned positive performance in 8 out of the 10 worst quarters for U.S. equities

Source: BMO Global Asset Management, Bloomberg, as of December 31, 2023.

A two-stage paradigm shift

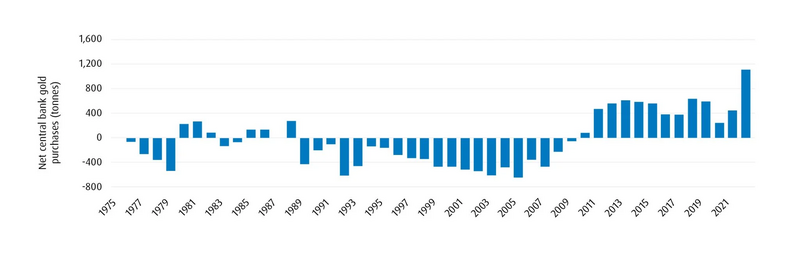

Recent developments, including record-high prices and central bank purchases, are the result of a longer-term paradigm shift—one that can trace its roots at least as far back as the Great Financial Crisis (GFC) of 2008-09. Beginning in the mid-1970s (only a few years after the United States abandoned the gold standard), central banks were net sellers of gold, their thesis being that there was less need for gold as a hedge since they were increasingly focused on inflation control as a core part of their mandate.

Chart 2. Net central bank purchases as reported by the WGC and GFMS – tonnes (1975–2022)

2022 was the all-time record year for central bank purchases of gold

Source: WGC, Metals Focus, Gold Fields Mineral Services (GFMS), Refinitiv GFMS. Note: GFMS was acquired by Thomson Reuters in 2011. Thomson Reuters later became Refinitiv.

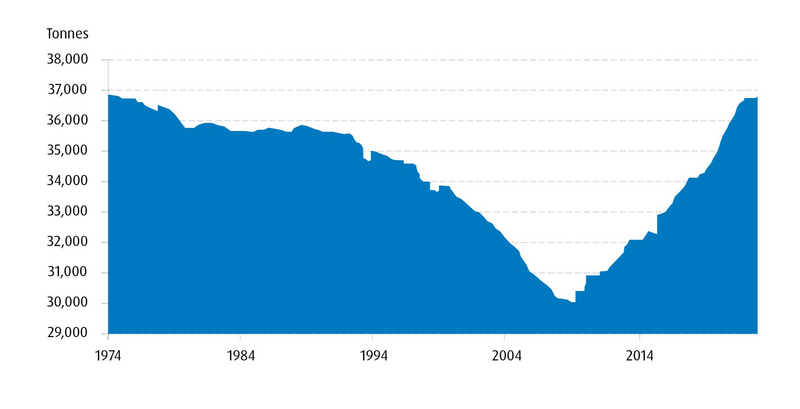

This trend reversed after the GFC, which served as a stark reminder of the value of gold as a hedge against economic downturns and potential currency devaluation. Government stimulus and increasing government debt during and after that period prompted central banks to rotate back to net buying—a trend that has yet to slow down. By late 2022, central bank gold reserves had returned to the levels they’d reached in the mid-1970s–and those reserves continue to grow.

Chart 3. Global central bank gold reserves are back to mid-1970s levels (1974–2022)

Source: WGC, as of October 31, 2022.

The Russian invasion of Ukraine in February 2022 further accelerated central bank gold purchases. Within weeks of the invasion, the United States and its allies had frozen US$300 billion in Russian assets and removed Russian banks from the Society for Worldwide Interbank Financial Telecommunications (SWIFT) transaction processing system. This made it difficult for Russia to access their U.S. dollar (USD) reserves. Not wanting to put themselves in a similarly vulnerable position, other countries made the decision to decrease the percentage of their reserves allocated to foreign currencies (which include the USD, Euro, and others) and increase the percentage of gold. The People’s Bank of China has been particularly active, and was the largest buyer of gold among central banks in 2023.5

Chart 4. Since 2022, Russia and China have increased their allocation to gold, both in absolute terms and as a percentage of total reserves

Gold reserves – Q1 2022

Country | FX reserves (US$B) | Total reserves (US$B) | FX/total Reserves | Gold reserves (kilotonnes) | Gold reserves (US$B) | Gold/total reserves | Gold/FX reserves |

Russia | 498 | 642 | 78% | 2.3 | 142 | 22% | 29% |

China | 3,252 | 3,373 | 96% | 1.8 | 122 | 4% | 4% |

Gold reserves – Q1 2024

Country | FX reserves (US$B) | Total reserves (US$B) | FX/total Reserves | Gold reserves (kilotonnes) | Gold reserves (US$B) | Gold/total reserves | Gold/FX reserves |

Russia | 424 | 590 | 72% | 2.3 | 166 | 28% | 39% |

China | 3,309 | 3,470 | 95% | 2.3 | 161 | 5% | 5% |

Source: WGC.

Aside from central bank activity, retail interest in gold in Asia has also provided some lift to prices. Again, China is a key player here. Over the last two years, sales in the Chinese property sector have faltered, economic growth has slowed, the renminbi (yuan) has been slowly falling, and the Chinese stock market hasn’t performed especially well. These challenges have caused retail investors in the country to increasingly turn to gold as a hedge. Retail access to gold has also been in the news in the western world, with retail giant Costco now enabling shoppers to buy gold bars at the same time they buy their groceries or other household essentials.

The greater risk: debt or de-dollarization?

The potential shift away from the USD as the world’s reserve currency—or ‘de-dollarization’—has been proposed or otherwise theorized by politicians, economists, bankers, and investors for years, and seems to pop back into the news every so often. With some in the BRICS (Brazil, Russia, India, China, and South Africa) nations floating the idea of introducing a unified currency to challenge the USD, the pertinent question for institutional investors is whether de-dollarization has reached a tipping point where it must be taken seriously as a portfolio risk.

There are several barriers standing in the way of any challenge to the USD. The first is political: in the present environment, it’s difficult to imagine countries with such diverse perspectives and ambitions being able to successfully coordinate in the creation of a stable, reliable currency, let alone one to surpass the USD. A second and related issue is trust. The USD has a decades-long history as the world’s reserve currency of choice, and it has earned the trust of the international financial community. Conversely, even if a new BRICS currency were to get off the ground, it would be starting from scratch reputationally. It is possible that negative sentiment from the likes of China and Russia could gradually peck away at the USD, but that is unlikely at this time to constitute an existential threat to its preferred status. More likely there will be a continuing rise in bilateral trade between certain countries using something other than the USD as the settlement currency.

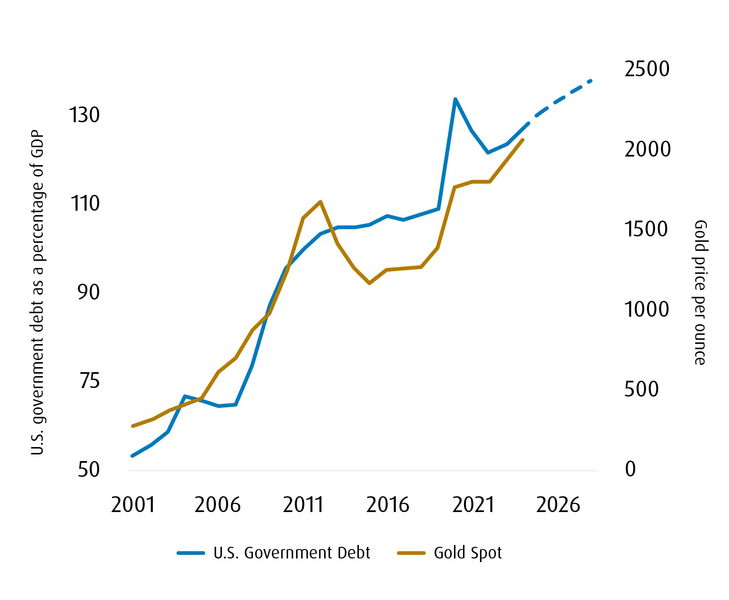

In our view, the more significant risk is government deficit spending, which has led debt to increase. U.S. public debt has risen dramatically relative to gross domestic product (GDP) since the turn of the century, standing at over 122% as of the first quarter of 2024.6 Government debt worldwide has likewise soared over that same time period, with the GFC and the COVID-19 pandemic both accelerating the trend.7

Chart 5. Gold spot price vs. U.S. government debt as a percentage of GDP

Source: Bank of America, as of December 31, 2023.

As U.S. government debt has risen, so too has the price of gold. Significant budget deficits are understandably worrying to investors, who may question the USD’s ability to maintain its purchasing power amid a dilutive expansion of the money supply. Gold, by contrast, is perceived as a more reliable store of value, further contributing to the metal’s record-high prices. While de-dollarization grabs the lion’s share of headlines, the government debt crisis is arguably the primary risk that institutional investors may wish to consider in evaluating the strategic role of gold in their portfolios.

Please contact your BMO Institutional Sales Partner for additional market insights.

Insights

Sources

1BMO GAM, Bloomberg, as of March 31, 2024.

2Dirk G. Baur and Thomas K. McDermott, “Is gold a safe haven? International evidence,” Journal of Banking & Finance, Volume 34, Issue 8, August 2010, Pages 1886-1898.

3“The use of gold in institutional portfolios,” World Gold Council, October 5, 2022.

4“The Gold Standard: Market Review,” RBC Capital Markets, June 2, 2024.

5“Gold Demand Trends Full Year 2023,” World Gold Council, January 31, 2024.

6“Federal Debt: Total Public Debt as Percent of Gross Domestic Product,” Federal Reserve Bank of St. Louis, as of June 6, 2024.

7Bank of America Global Investment Strategy, Bloomberg, Haver.

Disclaimers

For Institutional Client Only

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management, are designed specifically for various categories of investors in Canada and may not be available to all investors. Products and services are only offered to investors in Canada in accordance with applicable laws and regulatory requirements.

This communication is intended for informational purposes only and is not, and should not be construed as, investment, legal or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Past performance does not guarantee future results.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

All figures and statements are as of month end unless otherwise indicated. Performance is calculated before the deduction of management fees. Past performance is no guarantee of future results.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.