Responsible Investment

How we voted: a recap of the 2024 proxy season

October 04, 2024

2024 proxy voting season 1 highlights | |||

|---|---|---|---|

Global | 54,865 Items voted | 12.5% Votes against Management | |

USA | 16,376 Items voted | 8.5% Votes against Management | 49% ESG Shareholder Proposals supported and abstained |

Canada | 6,660 Items voted | 14% Votes against Management | 45% ESG Shareholder Proposals supported and abstained |

Table 1: Items voted globally, in the U.S., and Canada along with respective votes against management and support for ESG shareholder proposals. Source: BMO Global Asset Management, June 30, 2024.

2024 proxy trends

The 2024 proxy season saw the emergence of a twofold trend: an increase in the number of shareholder proposals filed and a decrease in average shareholder support for these resolutions.

An assessment of Russell 3000 annual meetings reveals a 5% increase in shareholder proposals filed over 20232.

The number of shareholder proposals filed at S&P 500 companies remained flat in 2024 compared to the previous year3.

In Canada, 130 proposals were filed by just 20 shareholders. 51 of these were withdrawn after agreement4.

Our own voting reflected this trend as well, with average votes against management going down and just under 50% support for ESG shareholder proposals we voted. Relatedly, an assessment by the Interfaith Center on Corporate Responsibility (ICCR) shows that overall investor support in 2024 for ESG resolutions is almost 1.5% lower than in 20235 as illustrated in the table below:

ESG resolution topic/theme | ESG resolution topic/theme | 2024 average investor support | 2023 average investor support |

|---|---|---|---|

Lobbying & political spending | +2% | 27% | 25% |

Corporate Governance | +3% | 20% | 17% |

Corporate Governance | -4% | 19% | 23% |

Diversity & inclusion | -3% | 23% | 26% |

Human rights | -4% | 16% | 20% |

Environment | -8% | 15% | 23% |

Table 2: Thematic assessment of support levels for shareholder proposals filed by members of the Interfaith Center on Corporate Responsibility of shareholder proposals Source: ICCR’s Shareholder Exchange, June 14, 2024.

The continued decline in support for ESG shareholder proposals from peaks witnessed in 2021 may be attributed to a host of factors, such as strong push back from certain groups and political actors against the consideration of social and environmental matters in business, general economic outlook, geopolitical risks, and the asks of the proposals themselves. Taken together, these seem to have affected investors’ voting approaches on these subjects 6.

In recent years there has also been a proliferation of counterproposals from shareholders that call on companies to generally do less on ESG factors. The 2024 season saw a 19% year-on-year increase of these counterproposals at Russell 3000 companies 7 and a notable 66% increase at S&P500 companies. Average support for these however continues to trend downward, to just under 2% 8. In Canada, 6 counterproposals were filed, and these were requests related to the reversal of and/or disclosure of costs of the company’s decarbonization plans 9.

What’s up and what’s down? A blend of traditional and new voting themes

Amidst the increased number of ESG shareholder proposals filed during the 2024 season, we observe a mounting focus on certain topics and themes:

Governance is back.

There was a marked uptick in the number of Governance proposals in Canada and the U.S. where average support was up at least 4% over the previous year with a record number of these proposals receiving majority support in 2024 across the

Russell 3000 10 and

S&P50011. In fact, Governance proposals were the only kind of ESG proposals receiving majority support this year. In Canada, a large number of proposals specifically addressed virtual-only Annual General Meetings (AGMs) and requested that companies ensure an in-person component to their annual meetings, requests we typically supported. This addressed an emerging concern from investors that since 2023, 53% of TSX Composite Index companies and 58% TSX 60 Index companies held virtual-only AGMs12.

Climate on the decline.

There was a decline in the number of climate-related proposals on the ballot. This is consistent with how we voted. In 2024, we voted 19 climate-related shareholder resolutions in Canada compared to 25 in the previous year, and 51 climate-related resolutions in the U.S. compared to 73 in the previous year. Average support for climate-related proposals is down at least 4% and none of these received majority support this year. A significant number of these resolutions were withdrawn after agreements were reached between the proponent and the companies, indicating the value of engagement and dialogue alongside the use of proxy mechanisms, in the furtherance of desired outcomes.

New technology concerns dominated in Social.

We noted a continued trend in Artificial Intelligence-related shareholder concerns with several resolutions filed at technology and media companies requesting greater algorithmic transparency, human rights risks and ethical guidelines, and response to misinformation capabilities of AI. Support levels for these proposals varied between 17% and 43%, including an instance of 53% of independent shareholders (and 16.7% of the overall vote) voting in favour13. These vote outcomes show that it is likely that AI will continue to gain prominence amongst shareholders, and we expect this to be a key topic of interest going forward.

Proxy voting at BMO GAM and our approach

At BMO Global Asset Management (BMO GAM), we exercise our voting responsibilities on behalf of our internally managed mutual funds and ETFs. Voting of proxies forms an important element of our responsible investment approach and is guided by our Corporate Governance Guidelines (CGGs), wherein we set our expectations of good corporate governance. The CGGs include, and are not limited to, subjects related to board independence and effectiveness, compensation, audit, risk and control, shareholder rights, disclosures, and social and environmental factors. We prepare and make available a proxy voting record on an annual basis for the period ending on June 30 of each year in respect of each of the BMO Mutual Funds and BMO ETFs and our vote disclosures are accessible here for Mutual Funds and ETFs.

BMO GAM’s Responsible Investment (RI) team actively votes proxies in the Canadian market as well as high-profile meetings in the U.S. such as those at priority companies and new or contentious shareholder proposals. The RI team informs its proxy voting decisions with an overlay of BMO GAM’s CGGs, followed by consultations with BMO GAM investment teams and engagements with corporate issuers. Our vote decisions – while rooted in the CGGs – consider any mitigating factors and contextual information shared during company engagements. These include the feasibility of the specific ask, any highlighted controversies, our own assessment of how the company compares to its peers, and in the case of shareholder resolutions – the potential of the ask to lead towards improved business practices. For example, where board diversity is not as per our expectations and the board indicates that it will address the issue in the near future, we are likely to consider the possibility of improvement and support management during the current AGM along with a flag to keep under review going forward.

In the case of shareholder resolutions wherever possible we engage with the filers and the recipient company to better understand any necessary nuances to help inform our vote decision. These engagements and consultations facilitate our case-by-case approach wherein we retain room for flexibility in cases where management or shareholder proponents make a strong case, and that may influence our final vote decisions. Typically, a vote against management is an escalation tactic that conveys/highlights to management our specific concerns related to the subject of that resolution.

Our partner reo©14, a third party voting service provider retained by BMO GAM, instructs meetings on our behalf in international markets, which ensures there is human oversight of a very large volume of voting items (mainly attributed to our index ETFs). BMO GAM monitors and retains the ability to instruct and override reo© instructions for meetings across all markets.

How we voted

Approximately 50% of BMO GAM’s voting this proxy season was at U.S. and Canadian company-related meetings. As such that is where we focus most of our write up on for this proxy season review. Our votes against management decreased from previous years, which was partially a result of voting guideline changes related to executive compensation, auditor tenure, and director tenure. As such, we vote against management where concerned practices or outcomes were below the expectations and market norms outlined in our voting guidelines.

Meetings voted across markets

Figure 1: Meetings voted across markets. Source: BMO Global Asset Management, as of June 30, 2024

Figure 1: Meetings voted across markets. Source: BMO Global Asset Management, as of June 30, 2024

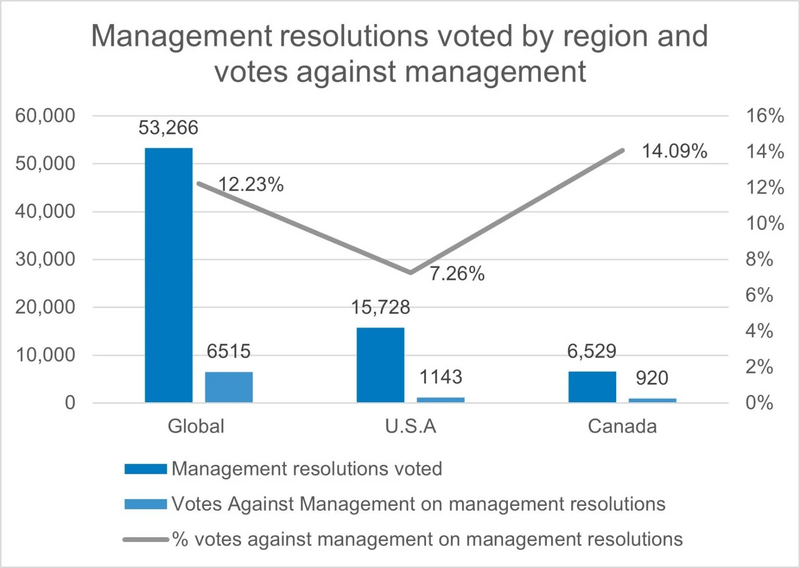

Figure 2: Management resolutions voted and votes against management (VAM) globally, in the U.S. and in Canada. Source: BMO Global Asset Management, as of June 30, 2024

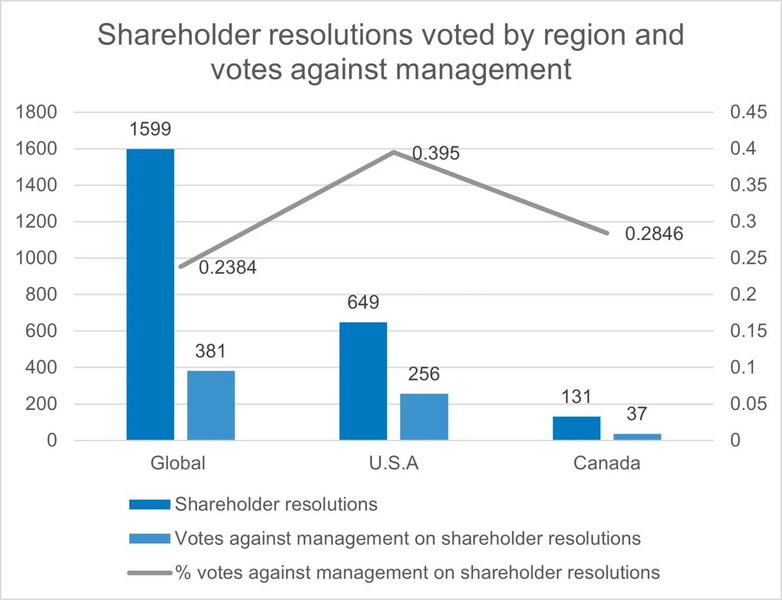

Figure 3: Shareholder resolutions voted and votes against management (VAM) globally, in the U.S. and in Canada. Source: BMO Global Asset Management, as of June 30, 2024

This season we were more likely to oppose management on shareholder resolutions than on management resolutions. In Canada, we voted against management 28% and 14% of shareholder and management resolutions, respectively. In the U.S., we opposed management in 39% and 7% of shareholder and management resolutions, respectively, while globally these were 23% and 12%. This trend also holds true in the context of our global voting.

Management resolutions

In Canada

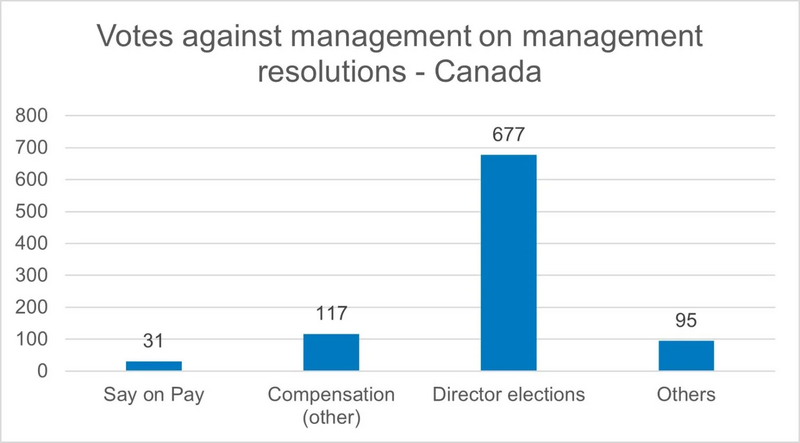

A significant majority of our votes against (74%) management resolutions in Canada were aimed at election of board directors due to concerns related to board independence, board effectiveness and board diversity.

Figure 4: Votes against management on different management resolutions in Canada. Source: BMO Global Asset Management, as of June 30, 2024.

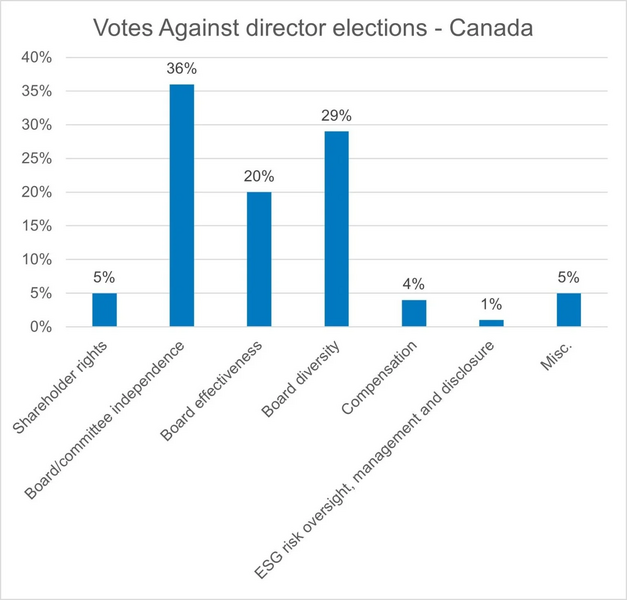

Figure 5: Thematic concerns that led us to vote against election of directors in Canada. Source: BMO Global Asset Management, as of June 30, 2024

Board independence concerns included high average board tenure and lack of independent members in the board and key board committees. High average board tenure tells us that the board composition is overly skewed towards long serving directors, which could potentially affect independent views from management. We also believe that board refreshment is a necessary component of high functioning boards to bring in fresh perspectives and diversity of thought.

Board effectiveness concerns included cases where the director is over-boarded, has low attendance in board and committee meetings or the board lacks in standard market practice such as a ‘three key committees’ structure on the board. For example, we assess whether a board nominee is over-committed and serving on too many boards at the same time, because we believe director duties have become much more complex over time, and directors should have the time and capacity to properly oversee management, as well as the capacity to respond to extraordinary circumstances such as a global pandemic. We consider serving as non-independent director on four or more public boards as over-boarded, which mostly will lead us to vote against the nominee.

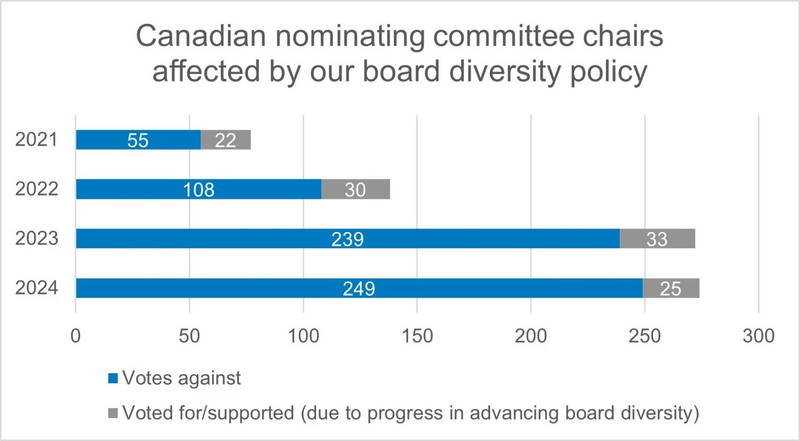

Lastly, around a third of our votes against director elections are related to inadequate board diversity. We voted against 249 chairs of nominating committees at Canadian company boards due to our minimum diversity expectations not being met: at least 30% of gender diversity and at least one director bringing ethnic diversity/identifying as from an underrepresented group. This represents a slight increase from 2023 when we withheld support from 239 nominating committee chairs. However, we are glad to once again report on progress on Canadian board diversity: in 2024 we were able to support at least 25 nominating committee chairs we had withheld support from in 2023 due to diversity concerns, indicating improvements at these company boards.

Figure 6: Votes Against and in support of Canadian nominating committee chairs because of board diversity. Source: BMO Global Asset Management, as of June 30, 2024.

Spotlight on our expectations on board diversity in Canada

In 2022 we raised our expectations on board diversity in Canada by increasing our minimum level of female representation on S&P/TSX boards from 25% to 30%, consistent with our commitment to the 30% Club Investor Group Canada. Additionally, we implemented a new voting guideline to withhold support from chairs of nominating committees in the absence of any racial diversity — unless the board conveyed meaningful plans, targets, and timelines to address the matter. This is consistent with our support of the Canadian Investor Statement on Diversity & Inclusion. Read more about our voting in 2022 here.

While we recognize sensitivities around assessing individual director identities, we encourage boards

to report aggregated data on the number or percentage of racial and other types of diversity and underrepresented groups, based on voluntary self-disclosure. Through membership of organizations such as the Canadian Coalition for Good Governance (CCGG) we have been advocating with Canadian regulators to put in place mandatory disclosure requirements on diversity beyond gender based on relevant categories consistent with human rights law and which would allow for comparability across peers, as already mandated by the Canadian Business Corporations Act (CBCA).

In 2023, we further enhanced our board diversity approach by requiring all Canadian TSX-listed companies to have at least 30% women on the board, beyond just the S&P/TSX. Because of this guideline change, our votes against nominating committee chairs more than doubled.

In 2024, while we did not change our voting approach, we are happy to see progress on board diversity. We do note that there has been a reversal in the trend of greater number of companies, year on year, improving their board diversity.

Finally, concerns related to executive compensation were the next most common reason (16%) for us to vote against management resolutions. These concerns included inadequate performance-based conditions and misalignment of executive payouts with shareholder value creation. We voted against 31 Say on Pay resolutions and 117 other compensation-related resolutions, including shareholder approval for executive omnibus stock option plans, equity incentive plans and other grants.

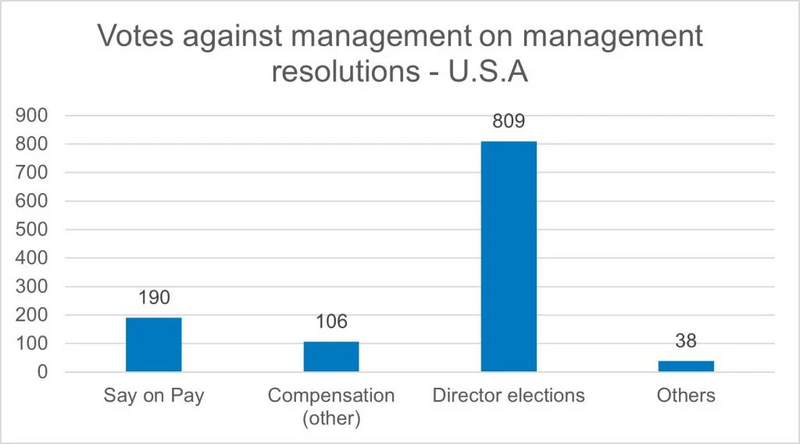

In the U.S.

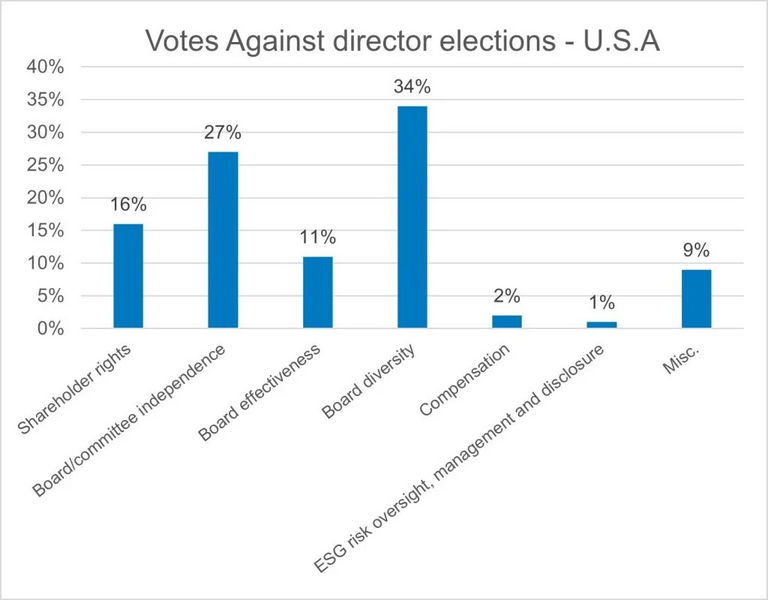

A significant majority (70%) of our dissenting votes against company managements in the U.S. were aimed at election of board directors due to concerns related to board diversity, board independence, protection of shareholder rights, and board effectiveness.

Figure 7: Votes against management on different management resolutions in U.S. Source: BMO Global Asset Management, as of June 30, 2024

Figure 8: Thematic issues that led us to vote against election of directors in U.S. Source: BMO Global Asset Management, as of June 30, 2024.

Concerns related to board diversity accounted for 34% of all our votes against director elections, slightly higher than in Canada. In the U.S. we expect to see at least 27% gender diversity and presence of at least one visible minority. 27% of our votes against director elections were due to concerns related to lack of or inadequate board independence, such as instances where there was a majority of non-independent board members, or a lack of requisite independence of key committees. Most of the remainder of director election-related votes against management were due to concerns about protection of (minority) shareholder rights, such as issuance of additional capital by management, change in jurisdiction of incorporation, and shareholder access to the board.

Lastly, 26% of our votes against management were due to concerns related to executive compensation, including 190 votes against Say on Pay resolutions and 106 votes against other compensation-related items, such as approvals for stock option plans and other grants.

ESG Shareholder Proposals

In Canada

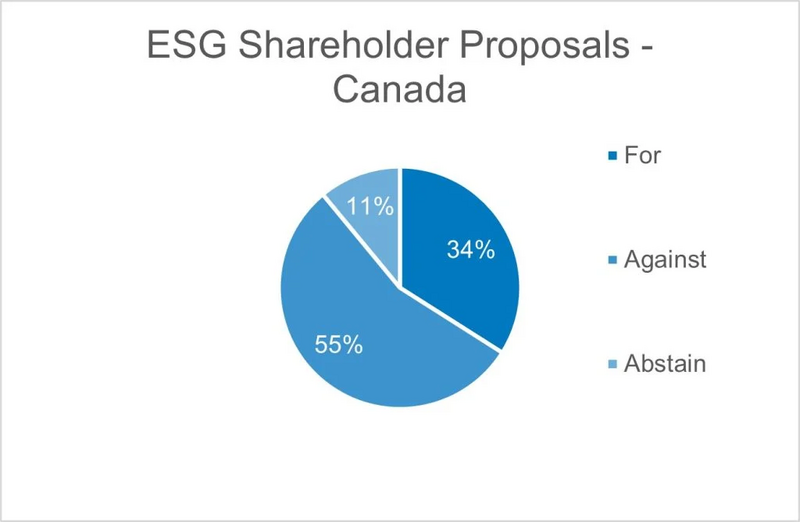

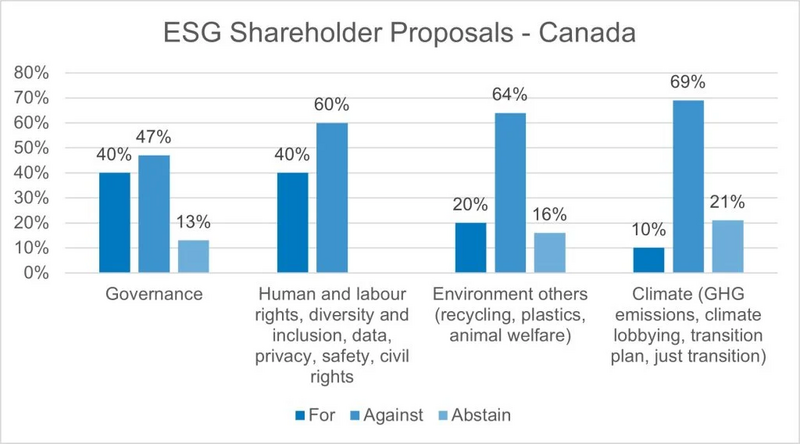

Figure 9: Our votes For, Against and Abstain on ESG shareholder proposals in Canada. Source: BMO Global Asset Management, June 30, 2024.

We voted in support of 34% (30 out of 88 resolutions) and abstained from around 11% (10 resolutions) of all ESG shareholder proposals voted in Canada. Our “abstain” votes represent cases where we agreed with the intent of the proposal, but not with the proposed solution. In Canada, we continued to abstain from several repeat proposals related to Say on Climate and CEO to median worker pay ratio.

Article photo #10 | How we voted: a recap of the 2024 proxy season

Spotlight: The rise of virtual meetings

In 2023, 52% of S&P/TSX Composite Index Companies and 58% of S&P/TSX 60 Index companies held virtual only meetings. The Canadian Council for Good Governance (CCGG), where we are a member, indicated shareholder preference for hybrid AGMs, a view echoed by BMO GAM and other investors via support for proposals requesting AGMs have an in-person component.

Early voting results include at least one majority vote (53.8%) at a Canadian retailer, and 48% support of independent shareholders at a Canadian software company15.

Governance – as mentioned earlier, we noticed a trend this year in the rise of governance shareholder proposals on the ballot in North America. In Canada, governance-related proposals accounted for over 53% of all ESG shareholder16 resolutions voted and included topics such as having an in-person component to virtual AGMs, executive compensation and language fluency of executives and directors. We voted for 19 and abstained from 22 of governance proposals; our support mainly focused on wanting to see hybrid (both in-person and virtual) AGMs from companies, rather than removing the option of having shareholders attend AGMs in person without putting that to a shareholder vote, an increasingly pronounced practice in the market.

Climate. The number of climate resolutions voted were down to 19 from 25 in 2024, with main topics including providing an annual Say on Climate to shareholders, improving emissions disclosure, and sharing more details around decarbonization plans. Recipients included companies in high-emitting sectors and the financial sector, where shareholder proponents requested disclosure of energy transition and decarbonization plans, disclosure of value chain emissions (scope 3), climate modelling and clean energy financing17. We supported 2 such proposals and abstained from 4. The proposals we supported asked for client engagement for energy transition plans at a Canadian bank, and request for disclosure of value chain emissions at an energy company. Reasons why we did not support the majority of climate-related proposals included our assessment of practicality of the ask, likeliness of the company’s ability to deliver given technological and methodological contexts, peer performance and precedence, sectoral analysis, and the case for market leadership. For example, we typically review Say on Climate proposals on a case-by-case basis and see it as a helpful mechanism only if companies are lagging on climate indicators and not receptive to shareholder concerns and feedback. As several of the same proposals, including requests for a Say on Climate vote, were repeated at different companies, we tended to vote the same way across those proposals.

Deciding our vote on ESG shareholder proposals

We will generally support E&S proposals that call on companies to improve their business strategy and public disclosures on managing material environmental and social risks in line with recognized international standards and frameworks. New and emerging proposals are assessed on a case-by-case basis. Elements we consider in our assessment:

Does the shareholder proposal’s ask address a material or salient ESG issue for the company or a systemic risk for its industry?

How does the shareholder proposal align with BMO GAM’s priority areas on climate action, social equality and overall good governance?

How is the company performing against peers

What is our precedence in supporting similar proposals in other or the same markets or sectors?

Can the shareholder request be reasonably implemented?

What does abstain mean? In certain cases, we opt to vote “Abstain” on shareholder proposals where we agreed with the proponent’s intention but find the actual request overly prescriptive or not reasonably implementable. The decision to abstain relates to us abstaining on the topic, not on the vote itself (it still makes our vote count). Our vote rationale text explains why we chose to abstain. This is our attempt of bringing nuance into the generally binary nature of voting.

Social and other (environment). We voted on 10 social proposals with the prominent subject among these being human rights. We supported 4 social shareholder proposals, including 2 related to human rights, and 1 each related to diversity and anti-microbial resistance. We also supported 5 other environment-related shareholder requests requesting reduction of plastic use (2) and report on water risk exposure in supply chains (3).

In the U.S.

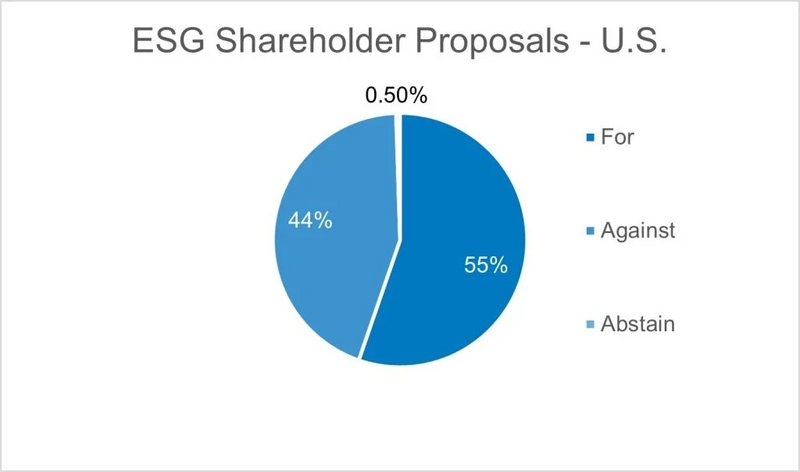

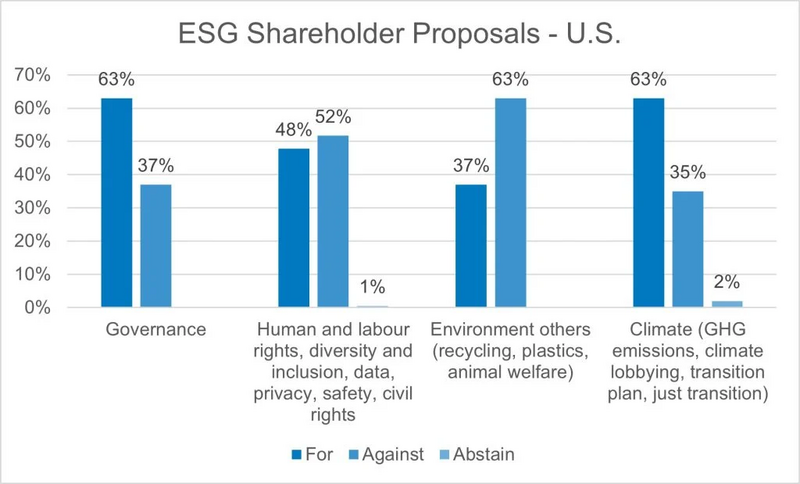

We voted 492 ESG shareholder proposals in the U.S. market and supported 270 or 55% of those. Aligned with the broader trend we pointed to at the top of this article, governance and social related proposals accounted for the large majority of ESG shareholder resolutions. These were largely voted by our third-party voting service provider reo® but include proposals we evaluated in-house.

Figure 11: Our votes For, Against and Abstain on ESG shareholder proposals in U.S. Source: BMO Global Asset Management, June 30, 2024.

Figure 12: Our votes For, Against, and Abstain across E, S and G themes in U.S. Source: BMO Global Asset Management, June 30, 2024.

Governance. We voted for 127 (or 37%) of 201 governance-related proposals. Typically, governance proposals in the U.S. included requests related to adoption of simple majority vote in board elections, board declassification, elimination of supermajority voting and reduced ownership threshold for shareholders to call a special meeting.

Social. We supported 98 (or 47%) of the 205 social-related shareholder proposals, covering topics such as human and labour rights, diversity and inclusion, data privacy and civil rights. Interestingly, we saw at least 8 resolutions related to artificial intelligence-linked risks, a rising topic this year, which included requests for greater algorithmic transparency, ethical guidelines, and misinformation response, the vast majority of which we supported.

Climate: We supported 32 (or 62%) of the 51 climate proposals we voted. These include topics such as disclosure of greenhouse gas emissions, climate lobbying, clean energy financing, climate transition plans and the Just Transition.Lastly, we voted a total of 35 Environment proposals (including recycling, plastics, and animal welfare), and supported 13 of these. For example, we supported a proposal asking for a report on efforts to reduce plastic use and another requesting a report on the company’s support for a circular economy for packaging.

Looking ahead

We will continue to monitor the trends related to lower levels of support for ESG shareholder proposals, and as always look to refine and update our voting approach.Topics that are on our radar, which we may be looking at going forward, include assessments of the robustness of metrics and incentive conditions for NEO compensation and board education and oversight of ESG matters. We also use the off-season to engage investee companies ahead of the 2025 proxy season on areas where we believe they could improve, and/or on concerns that led us to vote against management in 2024.As part of our global voting approach, we withhold from responsible directors, i.e., director nominees with oversight of E&S topics, at companies in high-risk sectors that severely lag in mitigation of environmental and social risks, such as – climate change, forced labour and nature-impacts. Given that the global voting season occurs year-round, we report on this effort once a year in our annual Responsible Investment report.To learn more about our engagement work, please visit our website to read our quarterly Stewardship reporting, available here, or our 2023 Responsible Investment report, available here.

Insights

Source

1We define the 2024 proxy voting season as the period from January 1 – June 30, 2024

2https://www.georgeson.com/us/insights/2024-proxy-season-early-look

3https://www.freshfields.com/49ee6e/globalassets/noindex/documents/trends-and-updates-from-the-2024-proxy-season.pdf

4Proxy Season 2024: Which ESG votes are key for investors? – Shareholder Association for Research and Education, 2024

5ICCR’s 2024 proxy review, Interfaith Centre on Corporate Responsibility, June 2024

6https://corpgov.law.harvard.edu/2024/04/24/environmental-social-policy-issues-in-the-2024-u-s-proxy-season/

7https://www.georgeson.com/us/news/2024-another-record-breaking-year-for-shareholder-proposals

8https://corpgov.law.harvard.edu/2024/06/12/six-early-takeaways-from-the-2024-proxy-season/

9Proxy Season 2024: Which ESG votes are key for investors? – Shareholder Association for Research and Education, 2024

102024 AGM Season: another record-breaking year for shareholder proposals – with renewed focus on governance, reports Georgeson

11Six Early Takeaways from the 2024 Proxy Season (harvard.edu)

12ISS, 2024 Canada Proxy Season Preview, March 2024

13https://www.morningstar.com/sustainable-investing/investors-challenge-ai-automation-proxy-voting-seasonopens in new window

14Responsible Engagement Overlay, a third-party pooled engagement service provider

15ISS, 2024 Canada Proxy Season Preview, March 2024

162024 proxy season preview: which ESG votes are key for investors – Shareholder Association for Research and Education, 2024

17https://www.investorsforparis.com/2024-agm-season-summary/

Disclaimers

This article may contain links to other sites that BMO Global Asset Management does not own or operate. Any content from or links to a third-party website are not reviewed or endorsed by us. Your use of any external websites or third-party content is at your own risk. Accordingly, we disclaim any responsibility for them.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

Commissions, management fees and expenses (if applicable) may be associated with investments in mutual funds and exchange traded funds (ETFs). Trailing commissions may be associated with investments in mutual funds. Please read the fund facts, ETF Facts or prospectus of the relevant mutual fund or ETF before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in BMO Mutual Funds or BMO ETFs, please see the specific risks set out in the prospectus of the relevant mutual fund or ETF . BMO ETFs and ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO Mutual Funds are managed by BMO Investments Inc., an investment fund manager and a separate legal entity from Bank of Montreal. BMO ETFs are managed by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.