House view

Cracking the Fed’s code

January 2024

January 24, 2024

CIO STRATEGY NOTE

With 2024 underway, our attention returns to central banks’ messaging.

What we’re looking for is a clear indication of the timing of interest rate cuts—monetary policy, in our view, is the key to certainty about the upcoming year. We will also be watching the unemployment rate as a healthy job market will keep consumers spending. Markets have been pricing in significant cuts as early as Q1. If, however, the U.S. Federal Reserve (Fed) or Bank of Canada (BoC) say that cuts aren’t happening imminently (which we think is a possibility) or that there might not be that many, then markets are likely to sell off. That would represent an excellent buying opportunity for us, as we’d be able to jump into certain quality names at a discount.

What we’re looking for is a clear indication of the timing of interest rate cuts—monetary policy, in our view, is the key to certainty about the upcoming year.

One reason we’d be eager to pick up equities on a potential dip is because we believe the economy will hold up relatively well in 2024. Last year, we correctly identified the strength of the consumer. Most asset managers felt consumers would be hit hard and recession would occur. As such, many went underweight Equities by quite a bit while we stayed close to neutral for much of the year. This year features a U.S. presidential election, and as Fred Demers noted in our previous issue, the S&P 500 has not declined in a year in which an incumbent president was running for re-election in the last 70-plus years. As long as consumers continue to spend (albeit while accumulating more debt) and massive job losses are avoided (as they have been so far), then 2024 should be another good year.

ECONOMIC OUTLOOK

Growth cools as rate cuts loom

U.S. inflation falls while Canada flirts with a recession. Indicators in Europe, meanwhile, show signs of bottoming, as China’s growth continues to disappoint.

U.S. outlook

The latest labour market data in the U.S. showed more signs of cooling, which is keeping markets well-priced for rate cuts. Payrolls registered a 215,000 increase in December, but job growth is slowing on balance, especially among cyclical sectors. Job openings fell to new cycle lows and as a ratio of unemployment are closing in on pre-COVID levels. Q4 real gross domestic product (GDP) growth is also tracking 2% or below, down from the lofty levels of Q3. But most importantly, core inflation made significant progress in Q4 and is set to fall below 3% in Q1. This sets the stage for rate cuts this year and largely explains the Fed pivot in December. In our view, rate cuts this year will be one key factor keeping recession risks low.

Canada outlook

Canada is starting 2024 on a weaker growth trajectory than its southern neighbour, with real GDP growth averaging just 0.2% over Q2 and Q3; this is a continuation of the economic bifurcation between Canada and the U.S. that we observed in the second half of 2023. At the same time, a technical recession looks to be avoided for now, with real GDP growth tracking 0.5% in Q4 and job growth steady through December. Population growth, which approached 1 million in 2023, remains a cushion to growth and the housing market. We expect growth to remain on the weak side and the economy to continue to flirt with recession, opening the door to rate cuts this year.

International outlook

Growth remains weak in Europe, particularly Germany and the U.K., though leading indicators in the Eurozone and the U.K. have been bottoming. The U.K. remains more vulnerable, with labour markets that are less rigid and consumers that are more exposed to variable mortgages. At the same time, inflation trajectories in both regions have improved. This is paving the way for rate cuts as soon as Q2. Economic growth is still expected to be weak in 2024 but expectations are a low bar to beat, especially if the European Central Bank (ECB) and Bank of England (BoE) cut rates.

Despite trickling stimulus, China’s economic growth continues to disappoint amid the grim overhang of the property sector and limited pickup in the economy’s credit impulse. Purchasing Managers’ Indexes (PMIs) continue to dash hopes for a re-acceleration of growth. In the broader context, trade flows are picking up, underpinning global growth in 2024.

Summary

Key risks | BMO GAM house view |

|---|---|

Inflation | The battle against inflation is largely over |

Interest rates | We have very likely reached peak rates in the U.S. and Canada |

Recession | Canada is on the cusp of a technical recession |

Consumer | In Canada, retail sales have been buoyed by immigration, but are declining on a per capita basis |

Housing | A weak point for Canada more than the U.S. |

Geopolitics | The U.S. is motivated to try to prevent the further escalation of the Israel-Hamas conflict |

Energy | Winter temperatures are a risk for Europe but stockpiles remain ample |

PORTFOLIO POSITIONING

Asset Classes

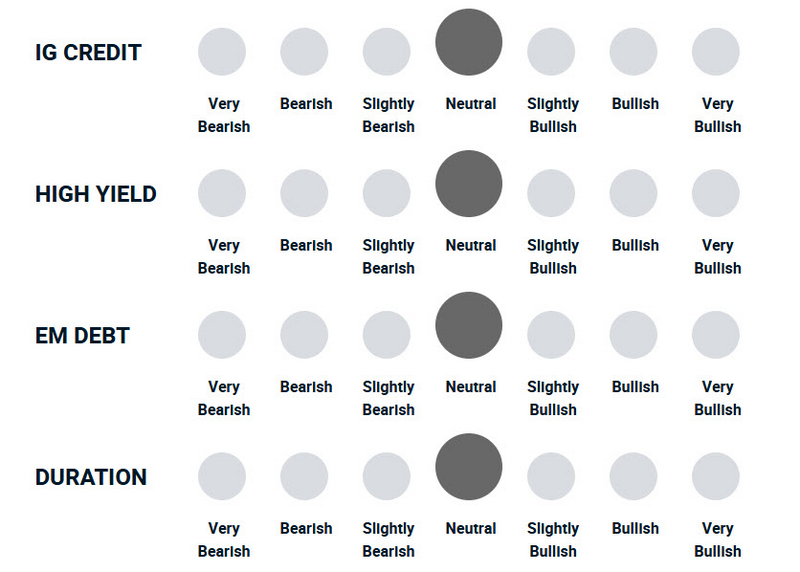

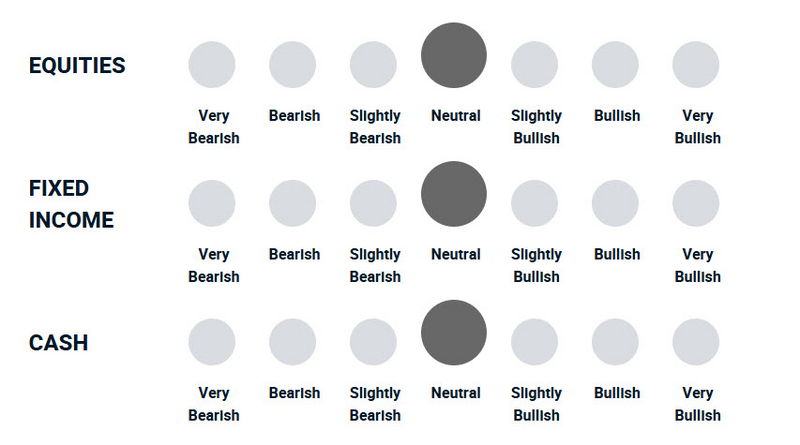

A choppier start to 2024 has shifted our view to neutral (0) virtually across the board. Yet our outlook for constructive financial markets to prevail this year remains intact, and for the broader economy to achieve a soft—or even perfect—landing.

It has been a dry first half of January after investors enjoyed a decidedly exuberant December. Following the year-end rally, we expect some market choppiness based on historical seasonal effects—it was part of our thesis when we went slightly overweight (+1) Equities in the fall. Our current view has shifted to neutral (0) on stocks—in keeping with our core position across asset classes for the moment. It is a ‘softer’ neutral rather than a panicked view or material change in direction. The first trading week of the year was three dicey days, yet some were suggesting that sample size would be representative of what to expect for the year—a rather specious assumption. There was no significant material change to drive the sell off, though admittedly, there has been somewhat conflicting jobs data, suggesting employment growth is still running a touch too hot.

In the bond market, we saw a snapback on fixed income rates, with the entire yield curve getting back above 4%. Ou

r view is that we are witnessing consolidation, not a correction or a trend reversal. Our base case for a soft landing still holds true. The latest U.S. Consumer Price Index (CPI) data is a bit higher than the market would have liked, but within the data, it appears as though the current high-rate environment continues to work as intended, having eliminated good inflation entirely, while whittling away more slowly at the stickier services inflation. The market is still pricing in the first cuts as early as the spring. That may be overly enthusiastic, but whether it is March, May, or later, the consensus is still that we’re going to see lower rates over 2024 as a result of policy normalization, along with some balance-sheet tapering in terms of quantitative tightening.

PORTFOLIO POSITIONING

Equity

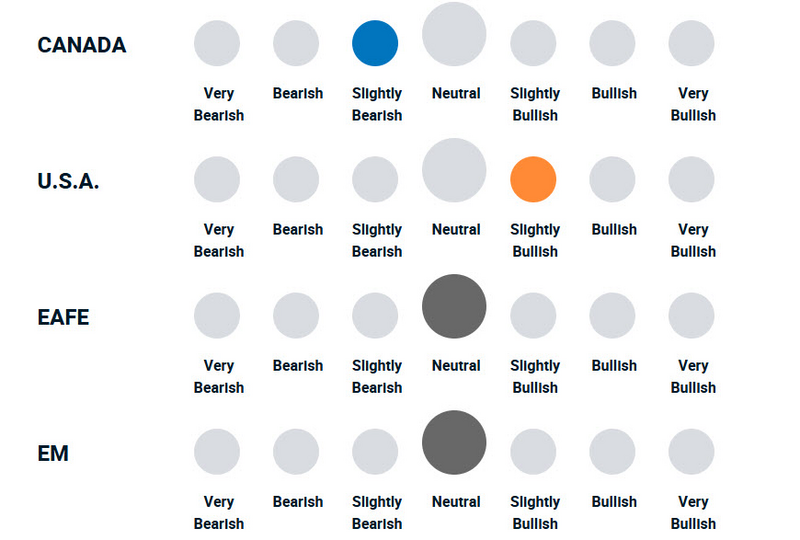

Stock markets got ahead of themselves to cap a late-year surge with some softness to start 2024 expected. We are, however, entering an attractive entry point in the cycle. We also see another lagging stretch for Canadian Equities amid a softer economic backdrop.

We expect broader Equity markets to perform well but we are likely in a too-far, too-fast scenario, which is why we have moved to neutral (0). We are, however, still constructive for a couple of reasons. One, interest rate hikes are likely behind us. Historically, in periods where the final rate hike has occurred from the Fed or BoC, it has served as an attractive entry point. The exceptions have been when the economy has been in recession, which we are not. As the soft-landing narrative plays out, it should benefit Equity markets. The data continues to support our view; economic growth, employment and inflation are all cooling—but not crashing. Coupled with a cessation in rate hikes, the stock market is relatively well positioned. But in the immediate term, we had a good run so we have taken some profits off the table.

In terms of positioning, we have not gone overweight small caps yet, however we do see a broadening out of participation to include more middle- and smaller-cap companies. That rotation is going to come as we get more clarity around where we are in this cycle. The shift would not necessarily be indicative of us growing bearish on the “Magnificent Seven,” but a lot of optimism is already priced in among those names whereas on everything else, we will likely see some catch-up.

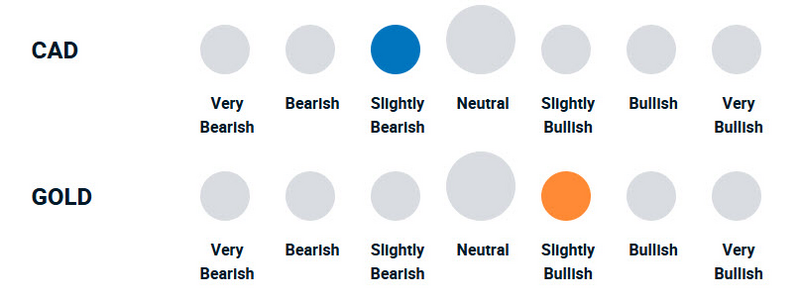

For the Canadian market specifically, we do expect the TSX to underperform U.S. Equities in the near term. One reason is because of the economy, where we are seeing conditions cool faster in Canada. That is going to be a headwind. Another factor is the currency, with the U.S. dollar (USD) more attractive than the Canadian dollar (CAD), which by extension makes investing in CAD-denominated securities less attractive.

PORTFOLIO POSITIONING

Fixed Income

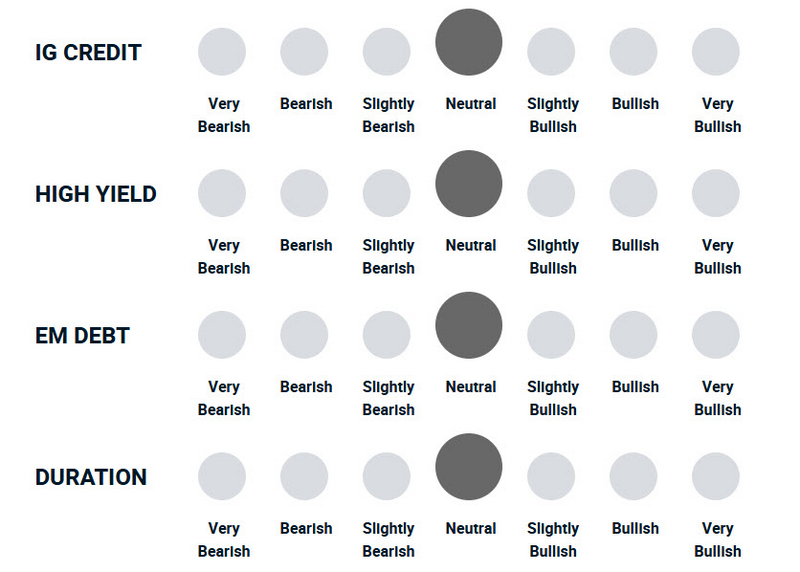

Similar to stocks, the bond market moved too far, too fast as investors priced in overly enthusiastic expectations for central banks to lower rates. We have tactically trimmed duration1 as a result. We are still constructive on long bonds, however, with cuts coming.

In terms of the tightening cycle, the BoC may move before the Fed, but we think both are going to be pushed out to mid-2024 or further. The market is pricing the Fed to cut its overnight rate before the BoC, but we think it could be the other way around because of the economic thesis; the Canadian economy is cooling faster than the U.S., creating more of an urgency to cut north of the border.

Neither central bank is likely to hike in March, and our view is that cuts could be pushed as far out as the third quarter. It is a central reason why we have made the change in our Fixed Income lens, pulling Duration back to neutral (0). Similar to Equities, the bond market moved really far, really fast to end 2023—we had a 100-bps rally in U.S. 10-year rates. Consequently, we have taken some profits while tactically trimming our Duration rating. Longer term, we remain positive on Duration bonds, because cuts will eventually be realized this year. But in the very near term, we could see a backup of rangebound rates before we see another leg in the rally.

With respect to issuer credit quality, we have kept our High Yield credit at neutral (0). A soft landing implies investors do not have to be as worried about sub-Investment Grade bonds, but at the same time, our view is that the soft-landing outcome is already reflected in spreads, which are approaching being historically tight. Investors are simply not being compensated enough for our view to move to overweight.

PORTFOLIO POSITIONING

Style & Factor

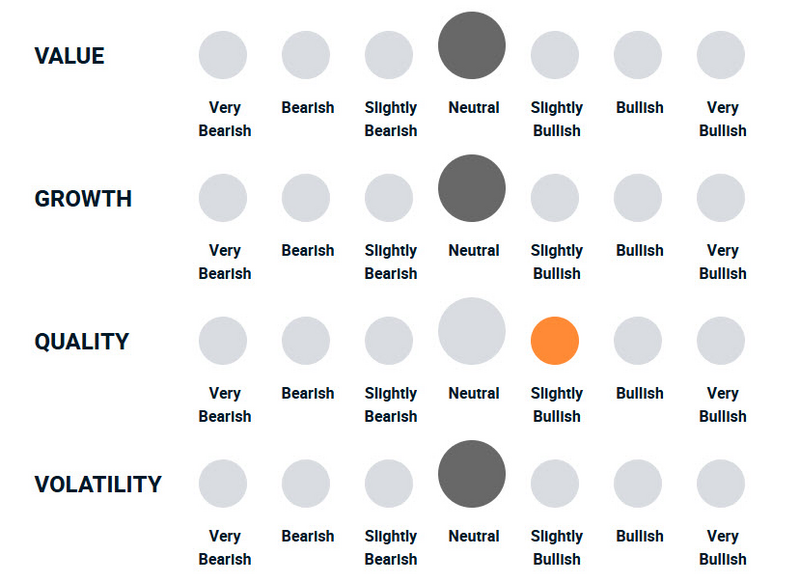

Gaudy price-to-earnings multiples within Technology has the market tilting toward Quality. However, we see room to run for Growth based on implied capex expectations. Value, meanwhile, has seen an uptick in performance.

In terms of Value versus Growth, we are neutral (0). On Quality, we are slightly bullish (+1) to provide the portfolios with a degree of defensiveness given that markets are pulling back on concerns over overvaluation. The primary driver of those concerns is Technology and its gaudy price-to-earnings (P/E) multiples. However, when you look at P/E-to-growth, valuations do not look so stretched. The question is: do you believe that growth rates are going to remain intact, based on themes such artificial intelligence (A.I.)? Currently, A.I. spending is about 1% of U.S. corporate capex, and is expected to rise to 12% by 2030. That’s a long-term trend that certainly supports more growth for chips and software.

That said, Quality never hurts—a key defining feature is free cash flow, which is synonymous with the larger software technology names in the Technology sector. Despite the now-conventional view that rate cuts are coming, we should remember that interest obligations are presently at very high levels; this is an advantage to companies with strong balance sheets and represents another reason to tilt into Quality. If the market is overestimating the pace or timing of cuts and we only get two or three over the course of the year, dividend payers will certainly look attractive.

Value has picked up a touch in terms of overall factor performance versus Growth, but it has been an underperformer for some time. In terms of Volatility, we do not expect any sharp flare-ups barring some unforeseen or unknowable event related to geopolitics. As of now, the VIX Index is under control.

PORTFOLIO POSITIONING

Implementation

Gold has come off a key technical high, but remains an attractive exposure given the macro uncertainty that is likely to persist. We are likewise focused on core decisions around asset classes and duration.

If we do see a flare-up in volatility, that would be a net positive for the USD, and consequently bad for the CAD. It is not our base case, but rather a tail risk situation.

Similarly in terms of Gold, the precious metal is still trading above $2,000 (USD) after hitting a key technical level of around $2,070 (USD). It has not revisited that high, but we still like Gold. Overall, last year was a reversal from the pain of 2022, but 2024 has its share of risks; they may be less economic or market-related, but perhaps more politically oriented. Looking at events such as the upcoming U.S. elections and conflicts in Ukraine and the Middle East, an exposure to Gold makes sense.

In terms of other implementations, we do not have any option positions on at the moment as we have narrowed our tactical positions. We are focused on our core decisions of asset class and duration.

Insights

Notes

1Duration: A measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as number of years. The price of a bond with a longer duration would be expected to rise (fall) more than the price of a bond with lower duration when interest rates fall (rise).

Disclaimers

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.