Alternatives

Introducing Altitude

A quarterly guide to the world of alternatives

June 17, 2024

When markets undergo a significant paradigm shift, as has happened recently, my colleagues and I at BMO Global Asset Management feel a deep sense of responsibility to evolve investing strategies for the benefit of Canadian investors. As part of this commitment, we have assembled a strong and capable Alternatives Distribution Team that will deliver client empowerment and education for investors across the spectrum—including Institutions, Advisors and accredited individuals alike. (Financial advisors should speak to their Wholesale Teams to request an introduction to an Alternatives product specialist.)

Our fundamental goal is to demystify Alternatives. Each team member has the knowledge and experience to not only present innovative strategies, but to navigate our clients across the complex landscape of private markets. The group’s mandate extends beyond the mere provision of investment opportunities; they are tasked with ensuring that clients—from the largest institutions to the most entrepreneurial accredited investors—gain a thorough understanding of these complex products, their inherent risks and their potential rewards.

Through one-on-one meetings, educational workshops and consistent thought leadership, the team will play a pivotal role in equipping clients with the information needed to make informed investment decisions. We aim to break down barriers in the alternatives market and usher in a new era of transparency that will redefine the possibilities for investors as they strive to build wealth for current and future generations.

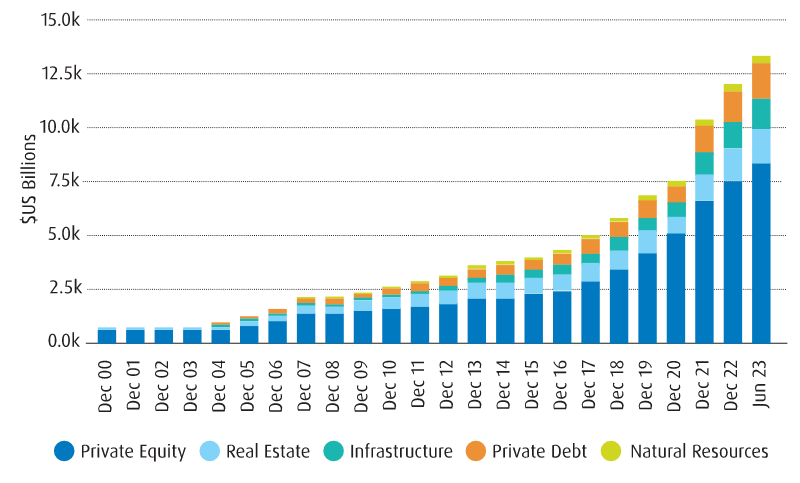

Assets Under Management Breakdown

Source: Preqin Pro, as of June 30, 2023.

Why now, and why us?

Interest in alternative investments is undeniably on the rise—and has been for more than a decade. Globally, assets under management (AUM) more than tripled to over US$12.5 trillion between 2013 and 2023.1 But while the attraction of private markets is clear—research shows they reduce overall risk and improve portfolio returns2—navigating the growing number of strategies and providers remains a significant challenge for many investors.

By virtue of being part of BMO Financial Group, we have the scale, relationships and global reach to offer a distinct advantage. As we know, private markets often require local managers who have boots on the ground. With our size, we have the ability to forge partnerships with the strongest and most reputable firms in any given geography or sub-asset class. Once we have curated these local partnerships, our innovation is to execute the strategies on our product platform using simple access vehicles that investors know and understand.

In addition to well-crafted products, investors need guidance from professionals who specialize in Alternatives products. This quarterly report, Altitude, is designed to shine a light on the inner workings of private markets. We will explore challenging questions, such as: What are the benefits of evergreens versus closed-ended funds? Which sub-asset classes are suitable in this market, and why? We will deliver actionable insights and, through tireless education and transparency, will help Canadian investors meet the future with a clearer understanding of their investment options.

Insights

Disclaimers

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management, are designed specifically for various categories of investors in Canada and may not be available to all investors. Products and services are only offered to investors in Canada in accordance with applicable laws and regulatory requirements.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under license.