IQ: Institutional Quarterly

Private markets: A mid-year review

August 27, 2024

As liquidity tensions linger between Limited Partners and General Partners, Adam Howarth, Partner, Co-Head Portfolio Management, Senior Member of Management at Partners Group, offers insight into the current state of the four major sub-asset classes of private markets and the advantages of an evergreen strategy.

This year has been an interesting time for private markets. At the start of 2024, we were optimistic about rate cuts—then expectations moderated as central banks appeared to slow down the timeline for normalization. The delay in reducing interest rates helped widened the growing fissure between General Partners (GPs) and Limited Partners (LPs). Now it appears monetary policy expectations are shifting once more.

LPs have understandably sought greater liquidity in their portfolios to manage through the uncertainty. GPs, on the other hand, have been hesitant to sell because bid-ask spreads have widened and calcified as a result of the liquidity crunch. This has made it difficult for institutions to invest more into the asset class, because they need to recoup some of the dollars that were previously allocated in order to fund new commitments.

Unfortunately, cash payouts slowed significantly in 2023. Nominally, private market fund distributions still exceeded the post-Financial Crisis era, but they were below normal, inciting a certain amount of anxiety among LPs. Multiple rate cuts from the U.S. Federal Reserve could, however, jumpstart market activity and help alleviate LP concerns.

Despite the challenging environment, now potentially represents an ideal time to enter the market. Central banks may now move sooner and faster, and all things equal, 2024 is looking to be a very good vintage for issuances. Fundamentals have remained strong in most areas. While sentiment may currently be in a trough, that in itself means it is perhaps likely that there is no where to go but up.

Through the lens of an evergreen strategy

In July 2023, Partners Group and BMO Global Asset Management introduced the BMO Partners Group Private Markets Fund in part to help bridge the liquidity1 divide. The strategy offers evergreen access to a global diversified private markets exposure, and was designed for smaller institutions or those that face challenges related to the time, effort and cost needed to build and maintain a private markets sleeve. The structure enables efficient access and immediate diversification, amplified by a focus on direct investing (60-80% of the portfolio).2

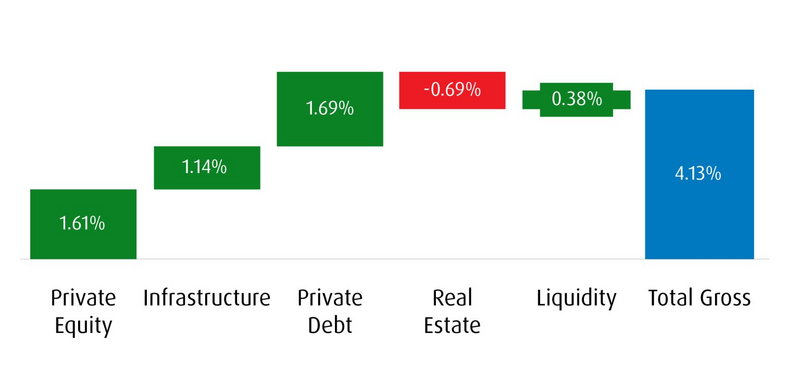

Gross performance contribution (since inception)

Source: BMO Global Asset Management, as of June 28, 2024.3

Now, as the strategy crosses its one-year anniversary mark, we want to share insights about its evolution over the past 12 months. The Fund delivered positive results as a whole and across a majority of the sub-asset classes, with the exception of Real Estate.

Key highlights include:

Secondaries positively impacted performance. In the past year, we found a tactical advantage in buying secondaries at discounted prices; however, each deal is always thoroughly examined from a risk and value perspective. It is critical to maintain robust criteria for secondaries—on par with our direct investments—because the expectation of every holding is to contribute to good long-term value creation, regardless of structure.

Private credit continues to shine. Private debt markets have been a bright spot in the portfolio since inception. The higher-for-longer environment combined with floating rates ensures that spreads are very healthy when policy is tight. On the underwriting side, we continue to be ultra-conscious about leverage, always checking for sound debt service ratios and good covenants in our potential holdings. As a result, default rates have remained low.

Infrastructure presents defensive growth opportunities. Infrastructure is another area of emphasis. Leveraging our scale and experience, we have been able to acquire positions both directly into assets and indirectly through the secondary market, entering other infrastructure funds at attractive buy-in points. Importantly, we continue to assess the underlying assets in order to better understand their value and potential. This portion of the portfolio remains defensive in nature. Inflation protections have typically been built into the contracts, offering a useful hedge against macro conditions in recent years.

Real estate can benefit from prevailing growth trends. Though the environment for real estate remains challenging, the prospect of rate decreases may unlock greater deal flow. In April, we received distributions from a real estate investment in the US Multifamily Portfolio (Riverside) owing primarily to the sale of a 562-unitgarden-style apartment community located in Austin, Texas. We have also gained a picks and shovels exposure to data centres, which receive second order benefits related to the growth story of artificial intelligence technologies.

Case studies: Hidden in plain sight

When considering what type of companies have been attractive in this environment, two success stories come to mind.

SRS Distribution:

Initially a Texas-based provider of roofing products, the company has in recent years expanded into building materials, landscaping tools, and pool supplies. It has evolved into a platform for the home renovation industry, forging a critical link between contractors and suppliers. Management made smart, calculated acquisitions along the way and unified what was a highly fragmented market. It is no surprise, therefore, that they eventually became an acquisition target themselves. In June 2024, we finalized a sale of the company to Home Depot at a significant premium to the shares’ carrying value.

DiversiTech:

Yet another supplier to the housing industry, the Mississauga, Ontario-based company delivers HVAC units for new build homes while also offering servicing and replacement to original equipment manufacturers (OEMs). The diversified revenue streams have insulated the business from a risk perspective, given that the replacement side of the business can step in to support earnings growth amid a potential slowdown in new home construction, and vice versa.

Population trends across the U.S. also show rising net migration to warm-weather states like Florida, creating a natural tailwind for HVAC purchases or maintenance. The key for DiversiTech, as with SRS, is competent management. The leadership team is disciplined about executing a strategic plan that drives returns, and have been able to maintain that focus in part by not having to worry about the pressures of public markets.

A common factor between these two holdings is that their brands fly beneath the radar. Unlike on public markets, where obscurity can be a detriment to shareholder interest, many private companies actually benefit from their anonymity. However, smaller institutions often find it challenging to meet their desired allocation to privates without facing liquidity concerns, denominator effects, or resourcing issues. The open-ended evergreen structure is a response to these difficulties, providing a diversified access vehicle that helps plan sponsors consistently meet their allocation targets while maintaining the liquidity to fund new opportunities as they arise.

Please contact your BMO Institutional Sales Partner for additional market insights.

Insights

Sources

1While the BMO Partners Private Market Fund offers a certain level of liquidity, the BMO Partners Private Market Fund is nevertheless subject to certain redemption restrictions, redemption delays and early redemption fees (see the applicable offering documentation for greater detail).

2In the context of private markets, direct investing involves the acquisition of a direct stake in a private company.

3Gross performance contribution is based on BMO Partners Group Private Markets Fund, and excludes all fund fees and expenses incurred as at June 28, 2024.

Disclaimers

For Institutional clients only

The information contained herein is provided to you for general informational purposes and on the understanding that you accept its inherent limitations, you will not rely on it in making or recommending any investment decision with respect to any securities that may be issued, and you will use it only for the purpose of considering your preliminary interest in investing in a transaction of the type described herein. An investment in the BMO Partners Group Private Markets Fund (“BMO PG Fund”) is speculative. A subscription for units of BMO PG Fund should be considered only by persons financially able to maintain their investment and who can bear the risk of loss associated with an investment in BMO PG Fund. Prospective investors should consult with their own independent professional legal, tax, investment and financial advisors before purchasing units of BMO PG Fund in order to determine the appropriateness of this investment in relation to their financial and investment objectives and in relation to the tax consequences of any such investment. Prospective investors should consider the risks described in the confidential offering memorandum (the “OM”) of BMO PG Fund before purchasing units of BMO PG Fund. Any or all of these risks, or other as yet unidentified risks, may have a material adverse effect on BMO PG Fund’s business and/or the return to investors. See “Investment Objective, Investment Strategy and Certain Risks” in the OM of BMO PG Fund. In addition to the risks described in the OM of BMO PG Fund, BMO PG Fund will bear the risks associated with the Partners Group BMO Master Limited (“Master Fund”) in proportion to the amount of BMO PG Fund’s investment in Master Fund. Prospective investors in BMO PG Fund should therefore carefully consider the risks described under “Certain risk factors”, “Business and structure related risks”, “Adviser related risks”, “Investment-related risks” and “Limits of risk disclosure” in the OM of Master Fund. Units of the Fund can only be purchased by Canadian accredited investors.

The information contained herein does not constitute a solicitation of an offer to buy or sell securities, nor should the information be relied upon as investment advice. Past performance does not guarantee future results.

Statements that depend on future events are forward-looking statements. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. These statements may be based on assumptions that are believed to be reasonable, however there is no assurance that actual results may not differ materially from expectations. Investors should not rely solely on forward-looking statements and should carefully consider the areas of risk described in the most recent offering documents.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain products and services offered under the brand name, BMO Global Asset Management, are designed for specific categories of investors in Canada and may not be available to all investors. Products and services are only offered to investors in Canada in accordance with applicable laws and regulatory requirements.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.