Many Canadian institutions remain under-invested in private markets, missing out on the full benefits of exposure to real estate, infrastructure, private credit and equity. To fill the gap, Samantha Cleyn, Managing Director, Head of Institutional Sales & Service, BMO Global Asset Management and Adam Howarth, Partner, Co-Head of Portfolio Management, Partners Group introduce a new capability to make it easier for investors.

Samantha, can you discuss the merits of private markets at the portfolio and asset class level—how does their addition to a portfolio aid plan sponsors?

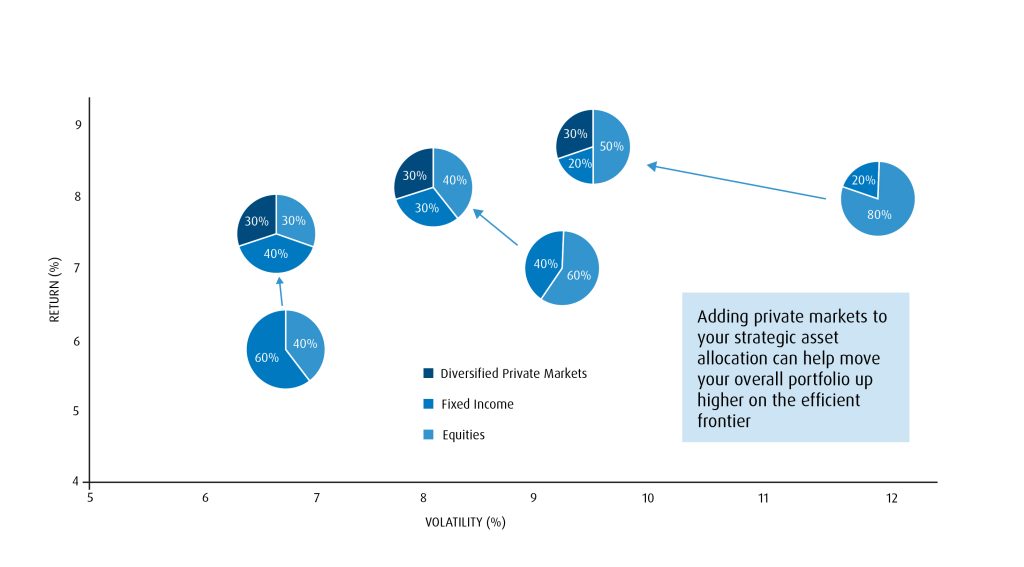

SC As an institutional investor, there are numerous benefits to adding private markets to your strategic asset allocation. At the total fund level, the addition of private assets alongside public equity and bonds can help investors maximize the risk-adjusted return of their overall portfolio. Effectively, it can help investors move their portfolio up and to the left on the efficient frontier, improving the likelihood of meeting their long-term objectives.

Private markets impact on risk-return over 20 years (2002–2022)

Portfolio breakdowns with Diversified Private Markets.

Equities: S&P/TSX Composite Index (Conservative 30%, Balanced 40%, Growth 50%).

Fixed Income: S&P Canada Aggregate Bond Index (Conservative 40%, Balanced 30%, Growth 20%).

Diversified Private Markets: Prequin Private Capital Index (Conservative 30%, Balanced 30%, Growth 30%).

For institutional investor use only.

Additionally, each sub-asset class within private markets plays a unique role in the overall risk-return equation. Private equity is often seen as a return enhancer given its higher risk profile, whereas private debt provides investors with floating rate exposure that protects capital in a rising rate environment. Real assets, like real estate and infrastructure, offer a level of resiliency to the portfolio in addition to inflation protection and a strong cash yield component.

We estimate the average institutional investor today has anywhere between 30-40% invested in private market asset classes, roughly equivalent to their equity allocation, while the largest plans in Canada are often north of 50%. However, many of the smaller institutions remain under-invested. We will discuss why that is the case, but first, it is important to understand how Canadian institutions typically start their private markets journey.

Initial allocations are often to domestic core real assets—either real estate or infrastructure. Private debt and commercial mortgages have also become increasingly popular. Once investors have tackled their core exposures, a logical next step is going global or potentially moving up the risk spectrum in terms of adding non-core, value-add and opportunistic allocations to their real asset exposure, or dipping down into less senior and higher-yielding tranches within the private debt space. A more return-focused private equity allocation is typically the last to be added because diversification and income objectives have largely driven allocations historically, but private equity is an interesting one today—especially vis-a-vis the opportunities in public markets.

Yet there are often implementation challenges or considerations with a private markets portfolio. Can you elaborate?

SC Generally speaking, it is not that investors do not appreciate the benefits offered by private markets. The challenge is, many plans underestimate the time, effort and cost required not only to build a diversified private-markets exposure, but to maintain that exposure over time. This is especially true if a client seeks to build out a program through closed-end fund structures. Getting invested typically requires many commitments that are called over time, and the “J-curve effect” and fee burden of paying on committed capital while an investor waits to get invested can be a material drag on performance—especially early on in a program build, when the investment amount is still low. Staying invested is equally challenging as funds start to return capital quickly in more mature programs. Managing this process requires resources to run pacing models, monitor top managers and their fundraising cycles to identify when new funds are being launched or raising capital.

A plan also needs a flexible governance structure that can react quickly to the tight timelines required by many private-market funds. You then need to monitor diversification, to ensure your private-asset allocations are spread appropriately across geographies, sectors and vintages. Most private market funds are quite concentrated, requiring allocation to multiple funds to achieve the right level of diversification. Lastly, the illiquidity of these programs can make adjustments difficult (if not impossible) when circumstances or markets change. A great example of this was in 2022, when many institutions faced “the denominator effect.” Public equity and bond portfolios both sold-off, causing an artificial increase in their weight to private assets. Illiquidity of these assets immobilized many investors who were not able to rebalance strategically, nor put new capital to work.

Introducing an evergreen solution, such as the BMO Partners Group Private Markets Fund, seems to address many of those challenges in one fell swoop. Adam, can you explain how?

AH I would start-off by saying that Partners Group has over 20 years of experience managing evergreen solutions on behalf of clients globally. One-third, or $56 billion (CAD), of our assets under management today are in evergreen offerings, such as the one BMO GAM is now offering to Canadian accredited investors. Our experience and expertise in managing perpetual capital has enabled us to develop a deep understanding of the unique challenges and opportunities associated with this investment structure, including managing ongoing new subscriptions, re-investing proceeds harvested from the portfolio and risk and liquidity management. Over the years, we have refined our approach to evergreen investing, leveraging our global network, rigorous due diligence processes, and active asset management to generate attractive risk-adjusted returns for our clients. We have also built a reputation for transparency, alignment of interests, and excellent client service, which has helped us to establish long-term relationships with our distribution partners, including now with BMO GAM here in Canada.

What an evergreen structure does is allows for capital to be invested more quickly than it otherwise would through closed-end structures. This results in institutional investors potentially getting to their strategic targets sooner and gaining an immediate exposure to a diversified portfolio across sectors, geographies and vintages. The evergreen nature of the fund also allows us as the portfolio manager to use a ‘Relative Value’ approach to then quickly take advantage of opportunities as they arise both within and across any of the sub-asset classes and dynamically shift the asset allocation over time. The ability to efficiently scale your investment is another key advantage, with cash automatically reinvesting to allow for greater long-term compounding of capital and as an investor you are only paying fees on that invested capital. We say that with an evergreen fund we are selling the compounding, but for investors looking for liquidity the BMO Partners Group Private Markets Fund will also offer that flexibility as well with monthly subscriptions and redemptions that can be made with a notice of three months.

Before we delve deeper in the details of the fund, could we hear more about Partners Group’s history and background in private markets?

AH Partners Group was founded in Switzerland in 1996 and has a 27-year track record of investing in private markets with our assets under management today standing at $184 billion (CAD) invested across private equity, infrastructure, private debt and real estate. Our client base is institutional, and we manage assets on behalf of over 800 clients globally through funds, separate accounts and co-investments. Partners Group’s origins are Swiss, however our investment focus has been global since the beginning and our investment team is spread across our 20 offices throughout North America, Europe and Asia. Originally focused on private equity, we have grown into the other asset classes as we have seen opportunities in the market and demand from investors. While we have specializations on the investment side, our decision making is unified through a Global Investment Committee process and an integrated mind set which allows for information sharing and unique insights. Within private markets we are staunch believers in taking an ‘entrepreneurial ownership’ to the businesses and assets we invest in. We want to roll up our sleeves and work with the management teams and operators to develop and implement plans to create value and grow the enterprises during our ownership period. To support these events, we continually look to enhance our capabilities and increasingly hire ‘from industry’ to ensure we have the right skill sets and knowledge to help this transformational journey.

Can you give us some more insight into how Partners Group invests and what advantages that brings for a product like this?

AH We have over 500 investment professionals working on behalf of our clients to find investment opportunities. Each professional is a specialist in their respective asset class and strategic focus area. We have a single global investment committee that evaluates each idea those specialists bring to it. That ensures we are investing in the opportunities anywhere in the world. It is my team’s responsibility as portfolio managers to identify what the portfolio needs and make the best use of the next dollar invested by our clients.

Overall, I would categorize Partners Group’s overall investment approach as thematic and transformative. Within each asset class, we follow three overarching giga themes that drive our investment sourcing efforts: digitization & automation, new living, and decarbonization. Tangibly, investable assets might include physical therapy chains, vision care clinics, data centres, engineering and software firms, or multi-family housing developments and logistics centres. Our investment teams often spend two or three years researching an industry and potential targets before committing to make a single investment. This allows us to understand what we are buying and ensure that Partners Group can actively drive value creation during our ownership, which is generally between five and seven years.

Turning to the BMO Partners Group Private Markets Fund, can you share some additional details, such as the targeted return and specific sub-asset class weightings?

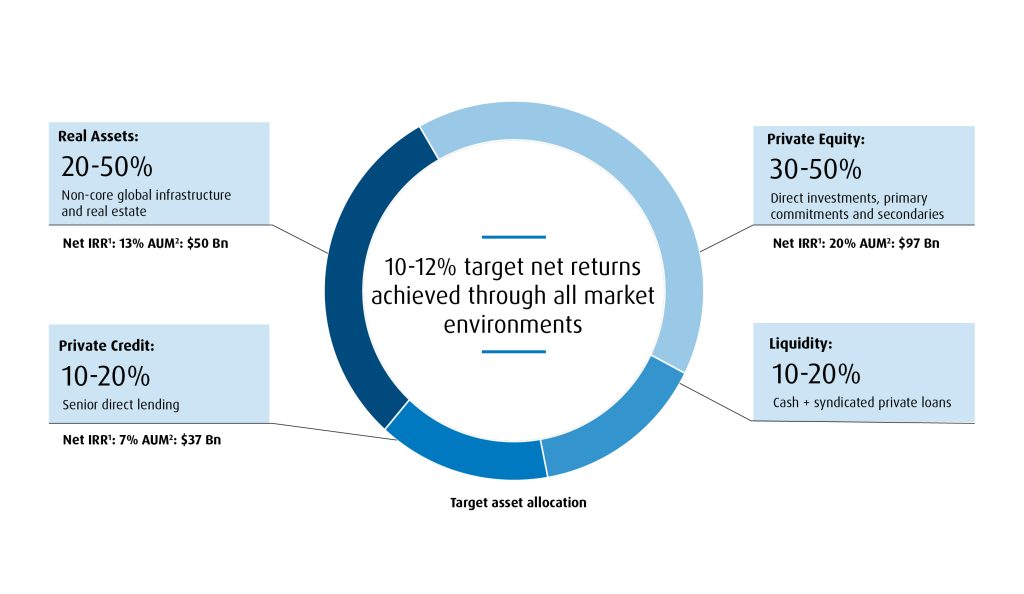

AH The solution that we have developed in partnership with BMO GAM offers institutional investors exposure to a globally diversified portfolio of real estate, infrastructure, private credit and private equity, all in a single solution. Institutions will not only be able to access the breadth and depth of Partners Group’s global private markets expertise in sourcing opportunities in the assets and businesses we hold, but benefit from the professional management of relative value opportunities across our platform to achieve a target return of 10-12%3 through a market cycle. The private equity investments are expected to be the highest performers in the portfolio. They are generally focused on businesses with strong growth (organic and acquisitive) as well as high margins and cash flow potential. We try to limit the amount of leverage on these businesses and believe the return is made through growing the top line. In the real asset allocation, the infrastructure investments will focus on platforms that we can help grow through increasing capacity and locking in strong recurring revenue. Likewise, real estate will offer strong global exposure to sectors and geographies where we can buy, fix and sell. Finally, private debt allows us to support growing businesses with strong cash flow characteristics while earning a contractual return that is senior in the capital structure.

The Fund will have a focus on primarily direct lead and co-investments (60-80%), allowing for a single layer of fees on the majority of the portfolio, which we view as a key differentiator relative to traditional fund-of-fund structures. The Fund vehicle will also give investors the ability to access monthly liquidity and its evergreen nature will help investors avoid reinvestment risk and benefit instead from long-term compounding of their returns.

Global asset mix designed to maximize risk-reward outcomes

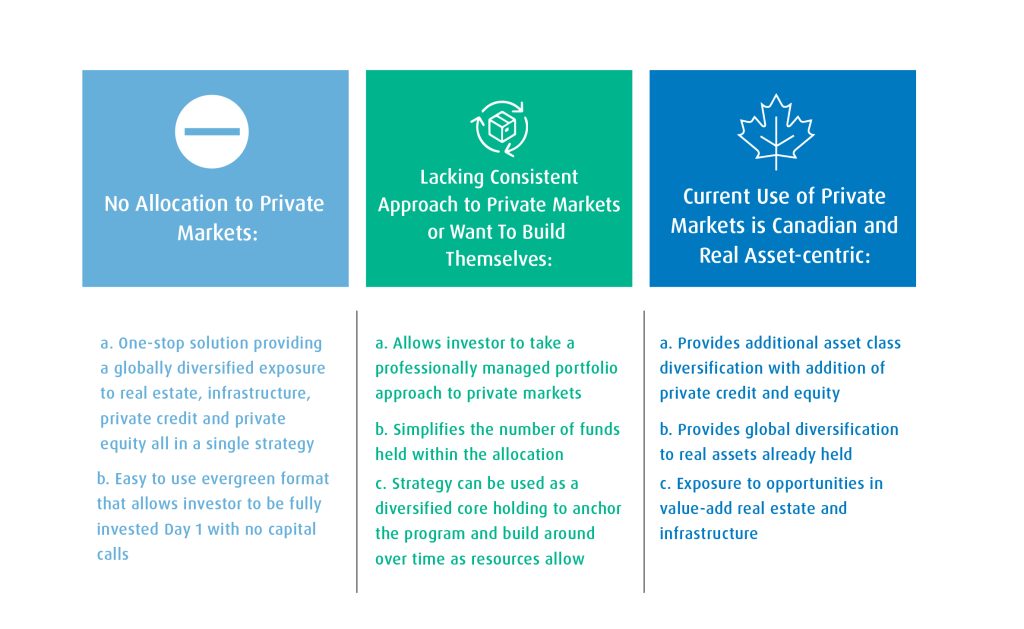

Many institutions are already allocating to private assets but there are many plans who are not. Is there an investor profile this fund can help?

SC We acknowledge that this will not be a fit for all institutional investors. Many have the internal staff, governance structures and external support (consultants and legal) to navigate the challenges and complexities of building and maintaining a robust and globally diversified private markets program. But there are a significant number of plans that do not, or may have under-estimated the complexity or have not had a consistent approach to building out their private markets allocation over time. As a result, they are behind where they could be today and missing out on the full benefits that private markets can offer. We feel this solution can potentially help get institutions where they need to be by filling those gaps.

Lastly, how would you differentiate the opportunity that the BMO Partners Group Private Markets Fund provides Canadian institutions?

SC BMO GAM is excited to bring this unique fund to market, which is the only way to access all of Partners Group’s capabilities and expertise in a single solution in Canada. While the number of evergreen solutions available in Canada has increased, many remain focused on a single asset class or sub-set of private markets, i.e. real assets. Few offer exposure to all four major private asset classes. We are also unique in offering Canadian accredited investors exposure to not only an established global player, but one with a long history managing outside capital and evergreen solutions. Additionally, Partners Group’s focus on direct investments as opposed to taking a more fund-of-fund approach we feel is distinctive and will give investors the long-term exposure to private markets they are seeking.

Please contact your BMO Institutional Sales Partner to learn more about the BMO Global Asset Management’s collaboration with Partners Group and the launch of the BMO Partners Group Private Markets Fund.

1 Since inception performance, as at31 December 2022.

2 Figures in Canadian Dollars, as at31 December 2022. Converted from USD to at 0.735332 USD/CAD.

3 Partners Group (2023). Performance shown for The Partners Fund USD I class as of 31 December 2022. Past performance is not indicative of future results. For illustrative purposes only.

There is no assurance that similar returns will be achieved.

Disclaimers

Certain of the products and services offered under the brand name BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations.

This communication is intended for informational purposes only and is not, and should not be construed as, investment, legal or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Past performance does not guarantee future results.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The attached material is provided to you on the understanding that you will understand and accept its inherent limitations, you will not rely on it in making or recommending any investment decision with respect to any securities that may be issued, and you will use it only for the purpose of considering your preliminary interest in investing in a transaction of the type described herein. An investment in the BMO Partners Group Private Markets Fund (the BMO PG Fund) described hereby is speculative. A subscription for units of the BMO PG Fund should be considered only by persons financially able to maintain their investment and who can bear the risk of loss associated with an investment in the BMO PG Fund. Prospective investors should consult with their own independent professional legal, tax, investment and financial advisors before purchasing units of the BMO PG Fund in order to determine the appropriateness of this investment in relation to their financial and investment objectives and in relation to the tax consequences of any such investment. Prospective investors should consider the risks described in the confidential offering memorandum (OM) of the BMO PG Fund before purchasing units of the BMO PG Fund. Any or all of these risks, or other as yet unidentified risks, may have a material adverse effect on the BMO PG Fund’s business and/or the return to investors. See “Investment Objective, Investment Strategy and Certain Risks” in the OM of the BMO PG Fund. In addition to the risks described in the OM of the BMO PG Fund, the BMO PG Fund will bear the risks associated with the Partners Group BMO Master Limited (Master Fund) in proportion to the amount of the BMO PG Fund’s investment in the Master Fund. Prospective investors in the BMO PG Fund should therefore carefully consider the risks described under “Certain risk factors”, “Business and structure related risks”, “Adviser related risks”, “Investment-related risks” and “Limits of risk disclosure” in the OM of the Master Fund.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.