With a soft landing in sight, stable employment, and inflation reverting to its target range, Douglas Porter, Chief Economist at BMO Financial Group, suggests the policy and economic backdrops are constructive for financial markets this year—a near-complete reversal from year-ago expectations.

Many forecasters remain cautious after what happened in 2023. The conventional wisdom a year ago was that we were going to have a recession in most if not all industrialized economies.

That did not happen. Instead, we witnessed a steady decline in inflation, relative stability in labour markets, and resilient economic conditions in the face of aggressive rate tightening. With that caveat in mind, for plan sponsors looking at what this year could bring for inflation, policy rates, as well as growth and employment levels, BMO Economics is forecasting what could reasonably be termed a ‘Goldilocks’ economy for the United States. In Canada, conditions will remain more variable albeit with the economic outlook a bit more sanguine versus a year ago, as well.

It is momentous that inflation has declined by five to six percentage points in major economies without a full-blown recession; a feat that has never occurred among industrialized economies in the post-war era. As 2024 dawns, the question is: can inflation settle back to central banks’ 2% target without an economic contraction?

Inflation Outlook

A dominant story for the next several quarters will be rates coming down the other side of the mountain. It has certainly been an encompassing theme for markets, which have rallied on the view that there is now a lot more clarity surrounding central bank policy. There are still many uncertainties – and the timing and pace at which rates come down is perhaps the biggest question mark.

Will inflation continue to moderate through the year? The data is becoming compelling with underlying inflation figures now easing alongside much calmer headline inflation. We should not declare victory just yet, with more work to be done—there are multiple underlying gauges that have generally been higher than the headline. But they too are now headed in the right direction.

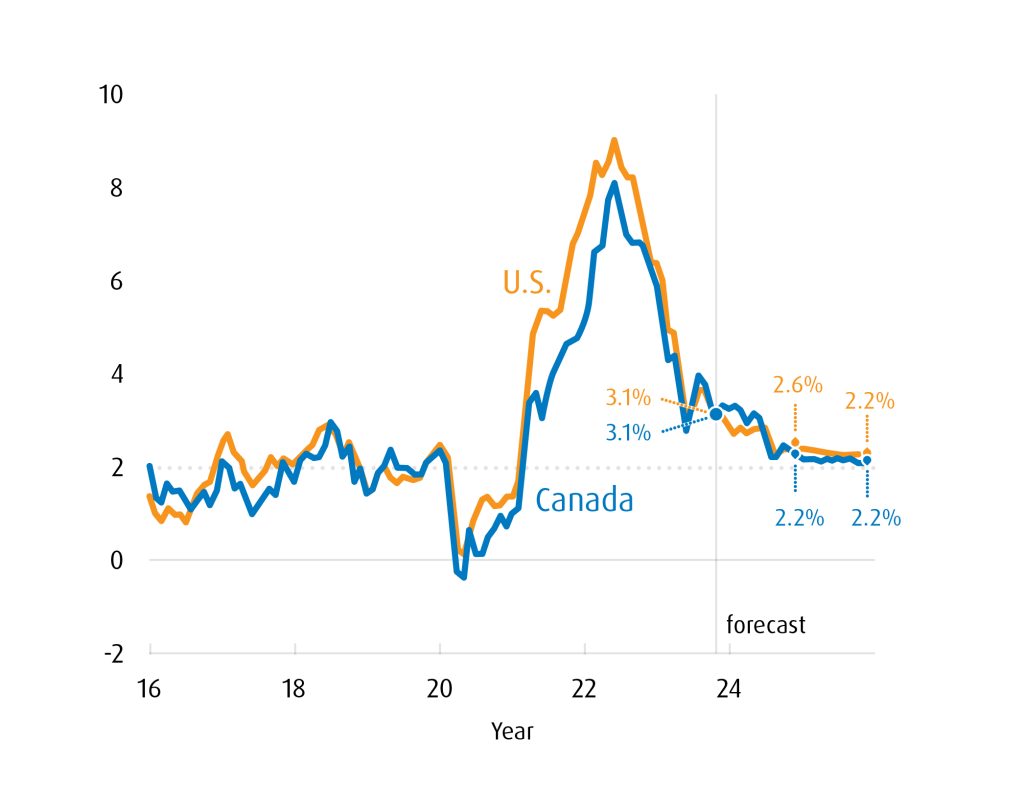

Chart 1. Inflation: Consumer Price Index (Year-Over-Year % Change)

Source: BMO Economics / Haver Analytics.

At present, prices for goods have remained flat with supply chains mostly back to normal, while demand for durables, such as clothing and furniture has continued to ease. The inflation story has firmly shifted into services. Even here, there are grounds for optimism; we’re starting to see wage pressures come off peak, setting a better table for the overall inflation outlook (see Chart 1).

If the economy can maintain growth while inflation settles back into target range, Jerome Powell and Tiff Macklem should be regarded as heroes.

Monetary Policy

Investors should not rush to judge the success of central-bank monetary policy over the past 18-to-24 months as it does take time for policy decisions to fully work through the system. However, at this point, we give both the U.S. Federal Reserve (Fed) and Bank of Canada (BoC) high marks for their recent performances.

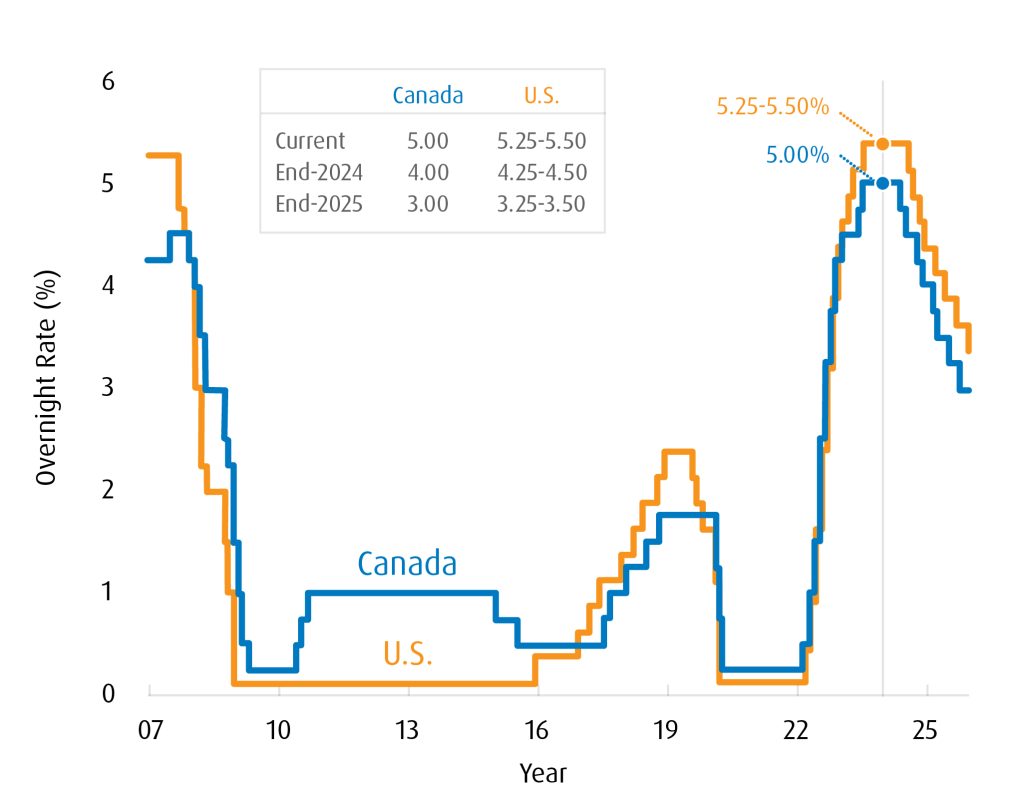

Chart 2. Overnight Rate

Source: BMO Economics / Haver Analytics.

Initially, both central banks completely dropped the ball in 2021, with the Fed failing to act on rising inflation sooner. However, since then, each has responded very well. At this point, they may have achieved the so-called Immaculate Disinflation, or what others have called The Great Escape. Inflation has come down without either economy suffering a full-fledged downturn. If they manage to pull this off, Fed Chairman Jerome Powell and BoC Governor Tiff Macklem should be regarded as heroes, frankly.

The BoC may likely be a bit faster on the way down, partly because Canada is experiencing a softer economic backdrop and arguably has somewhat lower underlying inflation.

Our expectations are for both central banks to begin cutting rates around the middle part of the year. Financial markets have cuts priced in by the spring; that is not impossible, but we are of the view that if central banks are going to make a mistake here, it is going to be remaining higher for longer than they need to—in other words, erring on the side of caution to make sure inflation is truly defeated. That victory over inflation isn’t likely to be clear until the second half of 2024 (see Chart 2).

Economic Growth

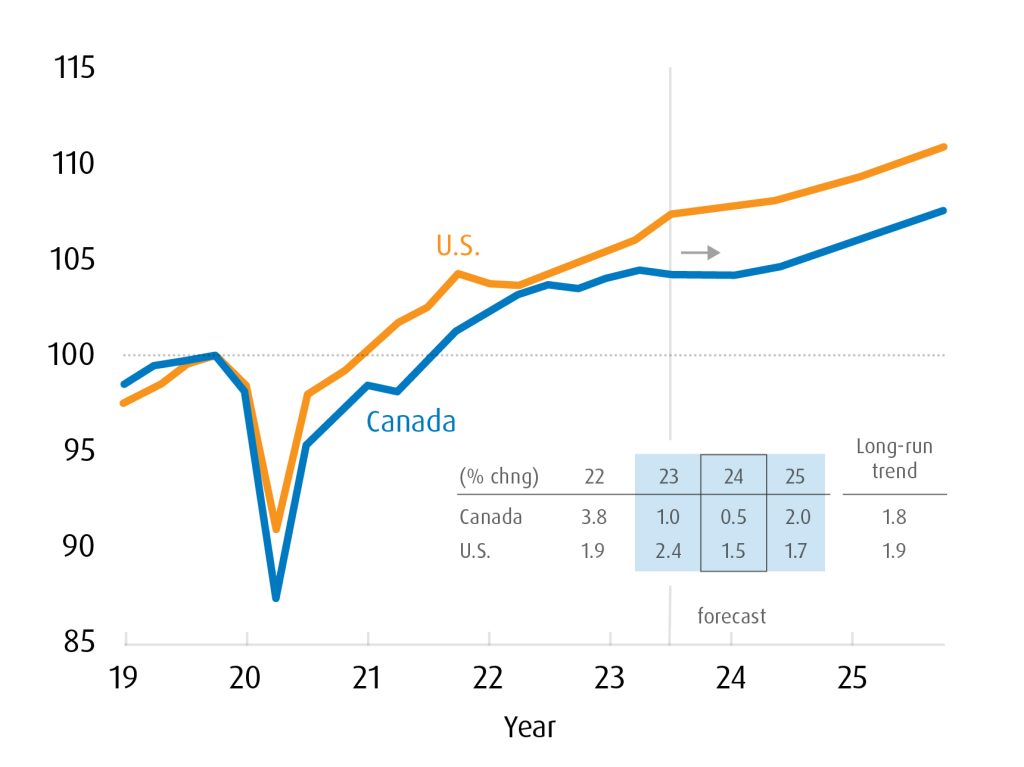

Our call is for a soft landing for the U.S. economy. We do not see a recession, while inflation falls close to target (2.0%) by the end of the year. We are much more optimistic about the prospects of a soft landing than we were 12-to-18 months ago. We cannot completely rule out a hard landing—just when everybody lets their guard down, we may still hit a shock. The global and North American economies are still vulnerable, given where rates are and with inflation still above target. But our official call is a soft landing.

For Canada, it is more nuanced and a much closer call on whether we see a bumpier landing. The domestic economy has struggled to grow, and is clearly lagging behind the U.S.

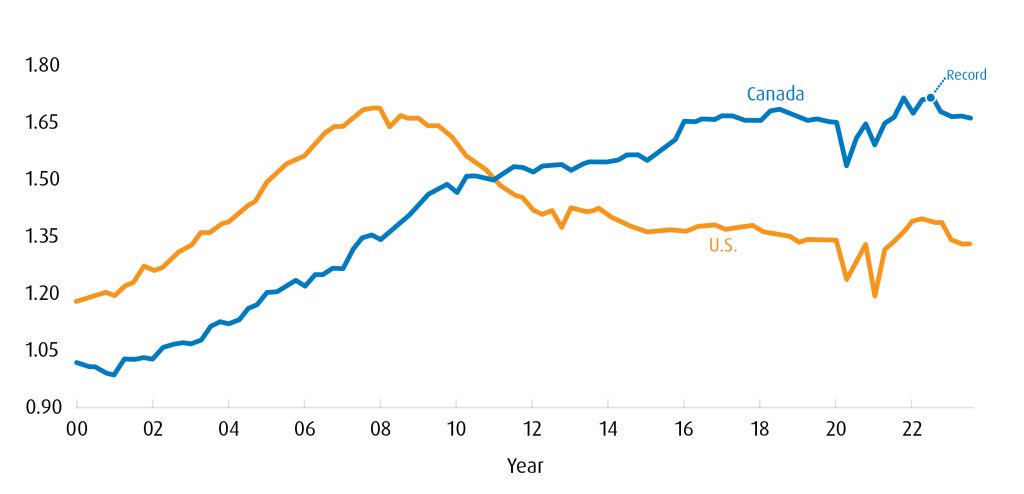

Households are much more indebted than in the U.S., which is a complete reversal from 15 years ago during the Great Financial Crisis. Much of that debt is mortgage loans that turn over every five years—not 30, like U.S. mortgages, which means Canadian households are facing a lot more pressure in the here and now.

Chart 3. Household Debt: Canada vs. U.S.

(Ratio to Personal Disposable Income)

Household debt = households, nonprofits and unincorporated businesses

Source: BMO Economics / Haver Analytics.

We see the Canadian economy barely growing over the next year, while there will almost certainly be a negative quarter or two along the way. That makes us much more hesitant to call this a soft landing.

Can we have a made-in-Canada recession? It has happened before. We tend to say that if you know where the U.S. is going, you have about 75% of the answer for Canada—but there is that other 25%, which can be enough to cause a downturn if circumstances coalesce a certain way. Do current circumstances rise to that level? We don’t think so. Still, Canada underperformed versus the U.S. and global economies in 2023 and our fundamental call is that it will again in 2024.

Chart 4. Real GDP: Q4 2019 = 100

Source: BMO Economics / Haver Analytics.

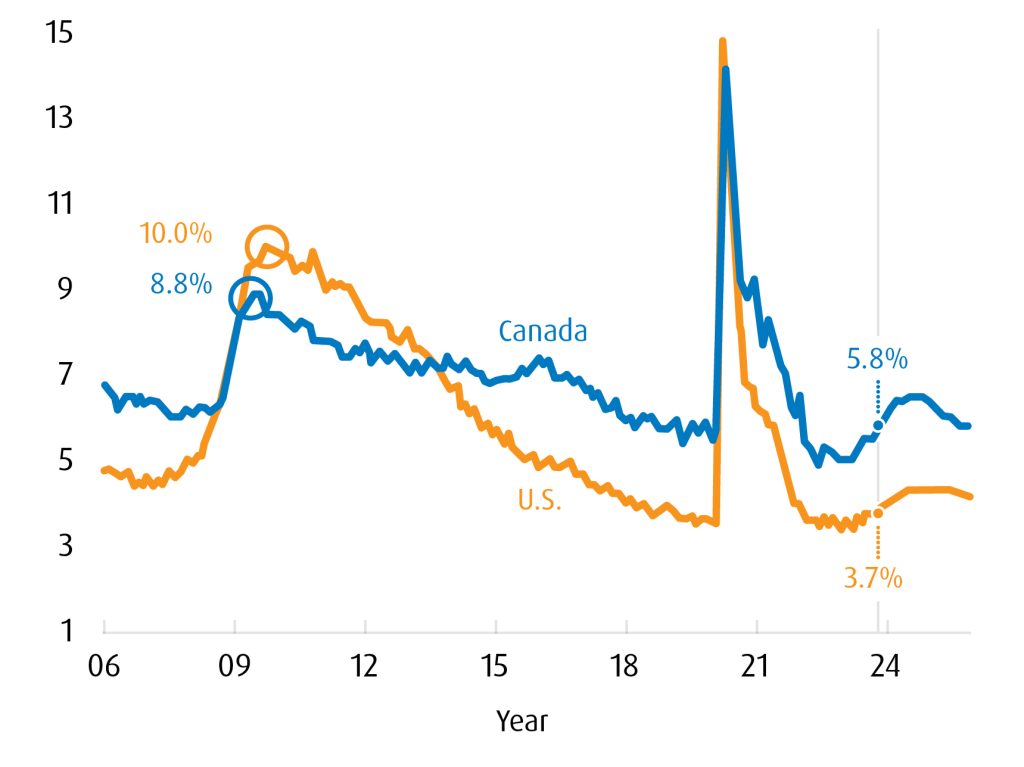

Labour Markets

In Canada, at the cycle low, the unemployment rate sank below 5%. We’re now trending higher and will likely get to about 6.5% before topping out. That is historically still a low jobless rate, and our view is that you need to see something a lot higher to call it a recession.

The U.S. has far less population growth then we have which means they do not need to churn out as many new jobs to keep the unemployment rate steady. They have seen a modest rise in their jobless rate, and we see it rising to about 4.5% this year. If that is where it gets, that is almost a Goldilocks economy—not too hot, not too cold—which very much fits with the soft-landing view.

Chart 5. Unemployment Rate (Percentage)

Source: BMO Economics / Haver Analytics.

Possible Shocks

The constant caveat, of course, is the risk of an exogenous event or shock that cannot be predicted. We are likely only one shock removed from a downturn.

There are some minor issues that might not rise to that level but will be sources of aggravation for the global economy. One is the ongoing war in Ukraine, with a similar risk building in the Middle East. Tensions between China and the U.S. could ramp up as well, while the 2024 U.S. presidential election will come to dominate market attention later in the year. It is not just the U.S. that is looking at elections; the United Kingdom, Mexico, India and many other countries are poised for the possibility of political change—including Canada. It is entirely possible we get a federal election before 2025. Geopolitics may indeed weigh very heavily on market sentiment in this new year.

Financial Markets

What does this all mean for financial markets? For equities, we are constructive for the year, provided we are not hit with another geopolitical shock. The economic backdrop coupled with the likelihood of moderating rates sets the stage for a reasonably robust performance for stocks, with our equity strategists forecasting double-digit increases for both the S&P 500 and TSX.

For context, there is zero correlation from one year to the next in terms TSX performance. In other words, whatever we did last year, tells you nothing about how the index will do this year—a 20% decline does not mean a 20% rebound, nor does it mean we are going to have another 20% decline. We experienced a very challenging year in 2022 and a moderately positive year in 2023; history would suggest, because we will have some rate relief, a better backdrop for 2024 compared to either of those periods.

For bonds, the storm has passed. Fixed income should see positive returns this year after an exceptionally challenging episode—arguably one of the most challenging of the post-war period. There are still some risks, i.e., elevated underlying inflation and a miserable fiscal backdrop, especially in the U.S. It is not clear sailing for fixed income just yet, but provided inflation does continue to moderate, it is a meaningfully more positive outlook compared with the market conditions we have just been through.

Please contact your BMO Institutional Sales Partner to learn more.

Disclaimers

Certain of the products and services offered under the brand name BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations.

This communication is intended for informational purposes only and is not, and should not be construed as, investment, legal or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Past performance does not guarantee future results.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The viewpoints expressed by the subject matter expert represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.