In the second half of 2023, the economic outlooks for the U.S. and Canada sharply diverged, with Canadian growth flirting with recession while the American economy demonstrated greater resilience. In this article, Brittany Baumann, Vice President, Investment Strategist, BMO Global Asset Management, examines the structural and policy differences that make this kind of bifurcation possible—and discusses what it may take for the close trade partners’ outlooks to reconverge.

A Sharp Divergence

At the start of 2023, the consensus economic outlook for both the United States and Canada was relatively bearish. As winter turned to spring, however, growth—underpinned by tight labour markets in both countries—proved to be more resilient than anticipated.

Then, in the summer of 2023, something changed. Growth expectations for the U.S. continued to rise while in Canada they began to fall. In Q3, the Canadian economy contracted by 1.1% as the U.S. economy grew by nearly 5%. As a result, Canada begins 2024 poised on the edge of a technical recession, while expectations of a downturn in the U.S. have been pushed further out.

Sector Composition and the Growing Productivity Gap

In examining the most recent economic bifurcation, two pertinent questions emerge:

-

- What caused this divergence?

- What are the structural differences between the two economies that create the conditions necessary for divergences of this sort to occur?

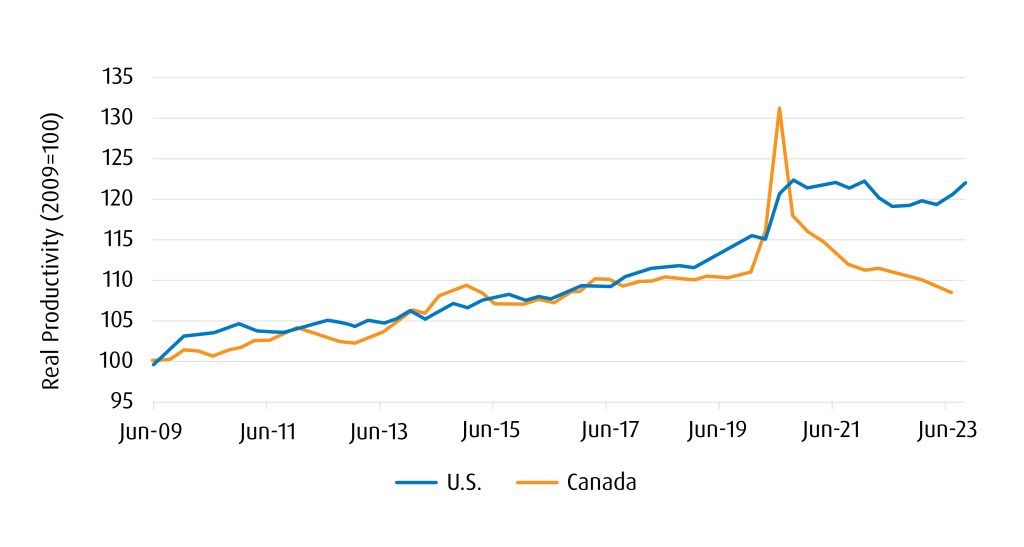

The answer to the first question is that Canada’s economy is more rate-sensitive than its southern neighbour as a result of household debt levels, consumer balance sheets, and the structure of the Canadian mortgage market; higher interest rates have therefore weighed more heavily on Canadian growth. Additionally, Canadian productivity has declined since the onset of the pandemic while U.S. productivity has recovered.

Weak Productivity Trends in Canada Continue Since the Pandemic

Source: BMO Global Asset Management, Haver Analytics.

The second question is more complex and, perhaps, more illuminating. The most recent bifurcation of the two economies was caused, in part, by differences in the countries’ housing markets, as was the case in 2008. In 2014, it was Canada’s resource economy that was the differentiator. It is important to note that a country’s equity market is not necessarily a mirror of its economy, but the two are correlated. In these examples and others, it was the neighbours’ respective sector compositions that was a key driver of relative performance. To wit: Canada’s more resource-oriented economy makes it more sensitive to global growth dynamics—including, in 2023, a global growth slowdown. Big Tech, meanwhile, has driven outperformance in the U.S. of late, which speaks to that economy’s strength as an innovator and major beneficiary of megatrends like Artificial Intelligence (A.I.). When U.S. demand is strong, the close trade linkages between the two neighbours does keep Canada’s economy insulated to a degree, but it is not sufficient to prevent occasional bifurcation.

The Importance of Policy

Policy, both fiscal and monetary, is another potential source of divergence between the two nations. The COVID-19 pandemic presents a recent example. In the early months of the crisis, budget deficits rapidly expanded on both sides of the border. Since then, however, deficits as a share of GDP have fallen in Canada to roughly 1% this fiscal year, while in the United States budget shortfalls continue to run near 6% of GDP, where they are expected to stay for the foreseeable future. This is a function of policy differences at the highest levels: the CHIPS and Science Act and Inflation Reduction Act, both of which President Biden signed into law in August 2022, appear to have crowded in investment but potentially put the U.S. on a less sustainable long-term growth path than its northern counterpart. The U.S. dollar (USD) continues to serve as a kind of universal currency haven—an advantage the Canadian dollar (CAD) does not present. That said, it is a luxury that the United States should not take for granted; if deficits become truly unsustainable, investors could start to flee.

Immigration policy is another consideration—we think it is unlikely to be a strong tailwind in the U.S., whereas Canadian policy requires a virtually unprecedented rate of immigration to be successful. We do not necessarily view high population growth as a bullish dynamic for long-term growth in Canada, as it does little for productivity and real per-capita incomes. Immigration does build up the labour supply, which serves as a cushion for housing demand, but this dynamic could evaporate quickly if job losses pick up.

Inside the Minds of the Fed and BoC

Are there any significant differences in philosophy between the U.S. Federal Reserve (Fed) and the Bank of Canada (BoC)? It is a question that economists continue to debate. Globally, central banks largely rely on similar playbooks—they use the same dynamic stochastic general equilibrium (DSGE) models, which aid in policy analysis and forecasting, and aim for the same 2% inflation target. Nonetheless, there are some subtle differences in approach. The BoC does factor Fed policy into their decision-making, in large part because divergent policy could impact the USD-CAD exchange rate. The BoC tends to be more attentive to Fed policy during a hiking cycle because rate tightening in Canada can lead to a stronger CAD that may, in turn, weigh on exports. Differences in recent policy can largely be chalked up to Canada’s economy being more rate-sensitive.

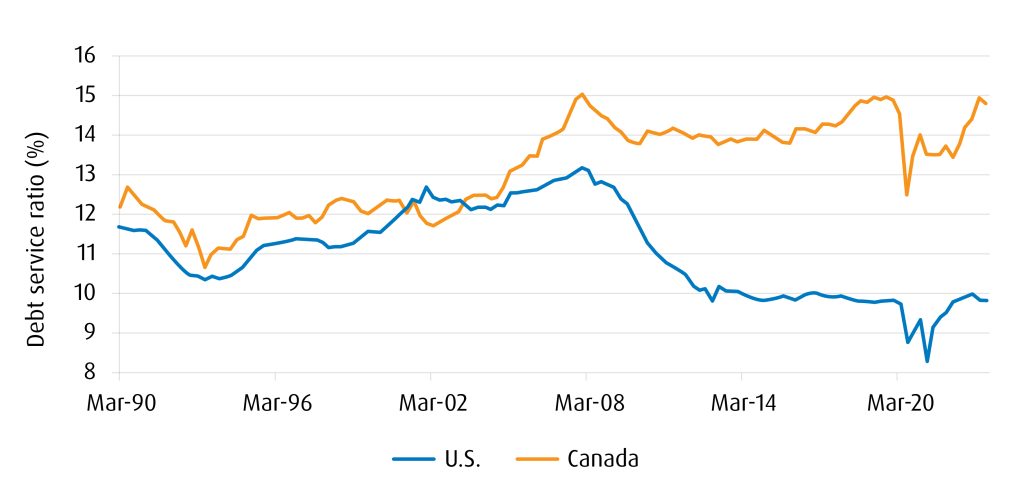

The Lasting Legacy of the Global Financial Crisis

Canada’s more rate-sensitive economy—and more indebted consumers—can, at least in part, be traced back to the financial crisis of 2008. At that time, the Canadian economy was more insulated than the U.S. economy, causing less of a negative overhang in Canada when the real estate bubble burst. Consequently, there was a much greater degree of deleveraging south of the border, and subsequent years of low rates propped up housing prices, creating the environment we currently find ourselves in. One noticeable impact of these differing dynamics is that the Canadian consumer appears to have run out of steam before their American counterpart: in Canada, consumer spending adjusted for inflation flatlined in Q2 and Q3 of 2023, while the U.S. averaged over 2% growth. As a result, the personal savings rate in Canada has picked up more than in the U.S., and we would expect that dynamic to continue.

Consumer Balance Sheets Remain More Vulnerable in Canada

Source: BMO Global Asset Management, Haver Analytics.

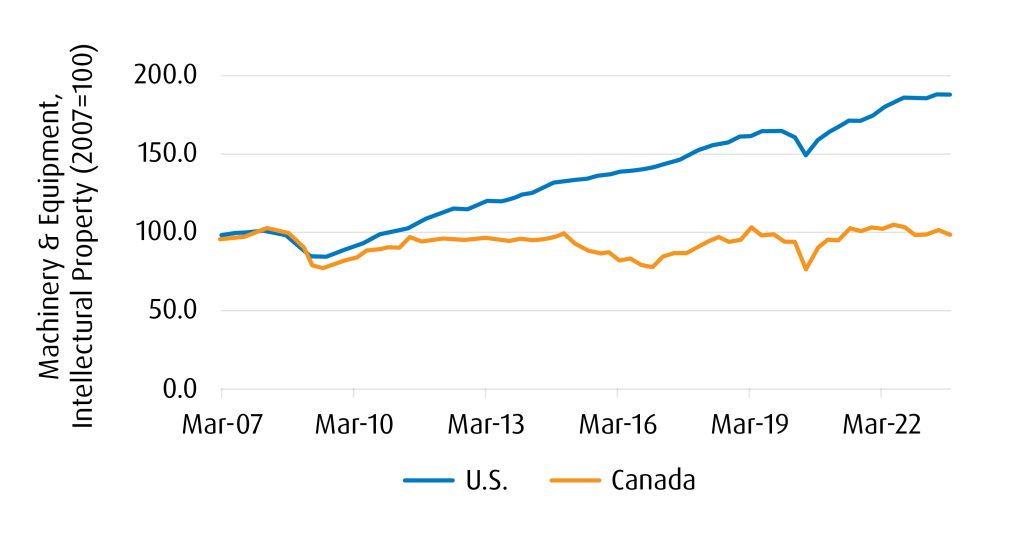

Productivity and Politics: The Keys to Reconvergence

Productivity is the key to long-term growth, and while the U.S. remains a hub of innovation and therefore an attractor of investment, Canada has lagged behind. In our view, significant changes in policy in Canada will likely be required in order to close that gap.

Business Investment Stagnant in Canada Compared to U.S.

Source: BMO Global Asset Management, Haver Analytics.

Much will depend on politics. Major elections loom in both countries: November 2024 for the U.S. presidential election, and 2025 or sooner for the next Canadian federal election. A Conservative victory in Canada could usher in a more resource-friendly environment, while in the U.S., a Trump victory could have wide-ranging implications on trade policy, including the possibility of blanket tariffs and renewed trade tensions. Under a potential second Biden term, significant trade tensions are less likely, but the pursuit of a green energy policy could continue to divert investment into the U.S. and away from other countries, including Canada.

One must also consider the dual macroeconomic trends of deglobalization and ‘nearshoring’ or ‘friendshoring’—the shift of supply chain networks from geopolitical rivals to allies. While the latter may create trade opportunities for countries aligned with the U.S. (like Canada), I’d hesitate to place too much emphasis on it as a bullish development for the Canadian economy given the potential political complications noted previously. Simply put, a lot will depend on the two countries’ respective political administrations. Globalization does appear to have peaked for now, but this development is rooted more in trade flows being diverted away from China and toward low-cost producers in Asia and elsewhere, as opposed to toward developed economies like Canada.

Compared to the United States, Canada’s major comparative advantage is in Energy and Materials. In our view, a more favourable tax policy and business-friendly environment, especially with respect to those sectors, would help put the Canadian economy on a more even playing field. The current productivity gap means that we would not expect the Canadian and American economic outlooks to converge in the near term. Canada remains the more cyclical economy, and as such, it is more exposed to the ongoing interest-rates-driven economic slowdown. Energy could serve as a tailwind and immigration continues to be an important economic cushion, but for now, the U.S. remains the more attractive place to invest.

Please contact your BMO Institutional Sales Partner to learn more.

Not intended for distribution outside of Canada.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Certain of the products and services offered under the brand name BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations.

This communication is intended for informational purposes only and is not, and should not be construed as, investment, legal or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Past performance does not guarantee future results.

All figures and statements are as of month end unless otherwise indicated. Performance is calculated before the deduction of management fees. Past performance is no guarantee of future results.

The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. All investing involves risk, including the potential loss of principal. Past performance is not a guarantee of future results.

Certain statements included in this material constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions. The forward-looking statements are not historical facts but reflect BMO AM’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although BMO AM believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. BMO AM undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

All Rights Reserved. The information contained herein: (1) is confidential and proprietary to BMO Asset Management Inc. (“BMO AM”); (2) may not be reproduced or distributed without the prior written consent of BMO AM; and (3) has been obtained from third party sources believed to be reliable but which have not been independently verified. BMO AM and its affiliates do not accept any responsibility for any loss or damage that results from this information.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.